Motor Vehicle Accident: Crucial Legal Advice to Remember

Our Blog

Motor Vehicle Accident: Crucial Legal Advice to Remember

Motor vehicle accidents happen in seconds but can impact your life for years. The decisions you make immediately after a crash often determine whether you receive fair compensation.

We at Harnage Law PLLC see too many people make costly mistakes that weaken their cases. Getting the right motor vehicle accident legal advice from the start protects your financial future.

What Should You Do Right After a Car Crash

The first thirty minutes after a motor vehicle accident determine whether your case succeeds or fails. While 38,000 Americans died in car accidents in 2020 according to the National Highway Traffic Safety Administration, millions more survived but lost thousands of dollars because they failed to act properly at the scene.

Document Everything Before Anyone Moves

Take photos of all vehicle damage from multiple angles, but most people miss the most important shots. Capture the entire accident scene and show vehicle positions, skid marks, traffic signals, and road conditions. The Insurance Information Institute reports that proper documentation prevents 60% of disputed liability claims. Your phone camera works perfectly, but take at least 15-20 photos and include close-ups of license plates, insurance cards, and driver’s licenses.

Collect Complete Information from Everyone Present

Exchange names, phone numbers, insurance companies, policy numbers, and driver’s license numbers with all drivers. Write down the exact make, model, year, and color of every vehicle that was part of the accident. Get contact information from witnesses immediately because they often leave quickly. Police officers who respond to your accident should provide their names and badge numbers for your records. The average car accident costs exceed $28,000 according to insurance industry data (making thorough information collection absolutely necessary).

Seek Medical Care Within 24 Hours

See a doctor within one day even if you feel fine because adrenaline masks pain and injury symptoms. The Centers for Disease Control and Prevention reports that 4.4 million Americans need medical treatment for car accident injuries annually, with many injuries that appear hours or days later. Emergency room visits create immediate medical records that insurance companies cannot dispute. Wait longer than 48 hours to seek treatment and insurance companies gain ammunition to claim your injuries came from something else.

These immediate actions protect your legal position, but they represent just the first step in a complex process that requires understanding your rights and available options.

Understanding Your Rights and Legal Options

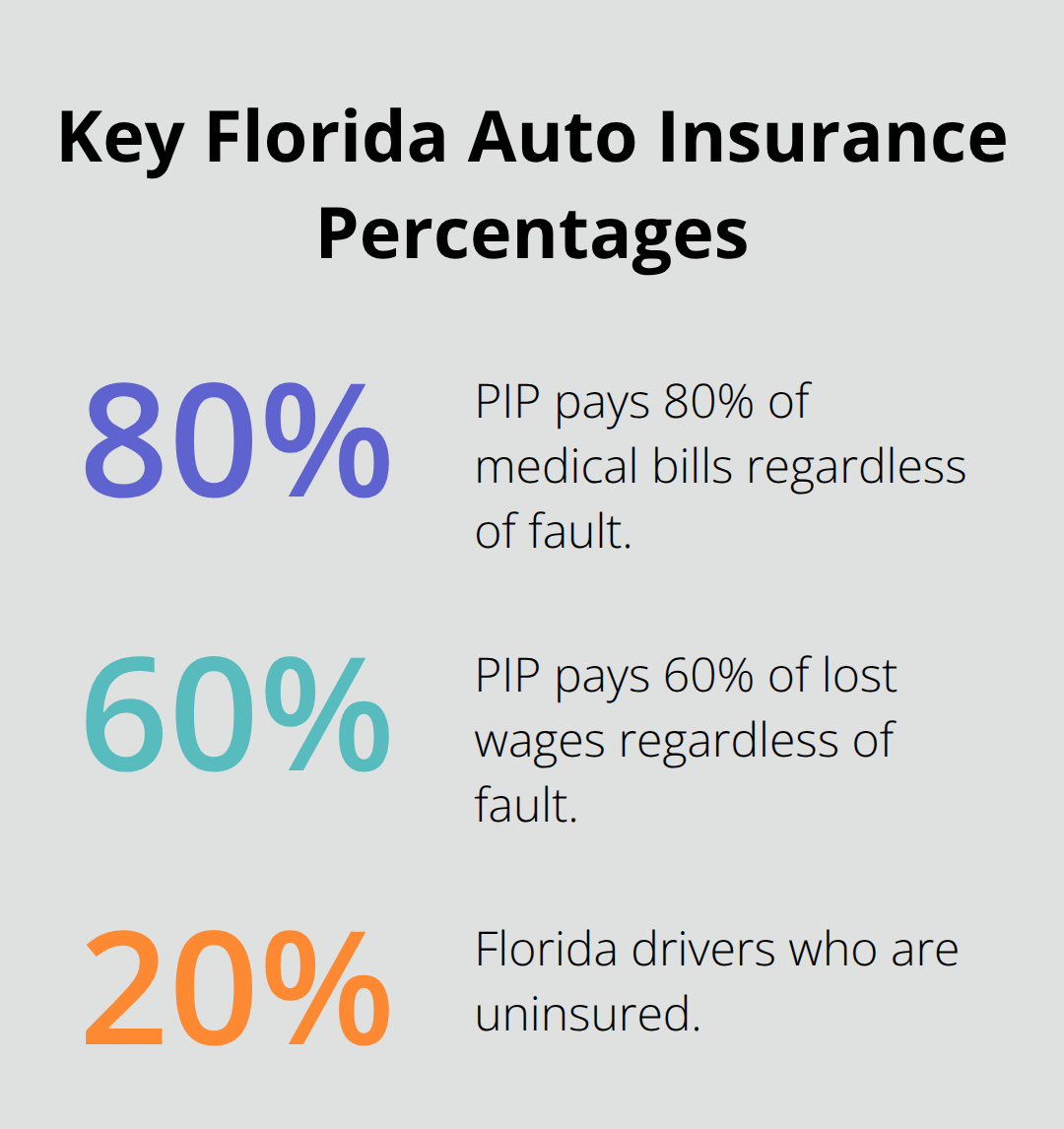

Florida’s Personal Injury Protection law requires every driver to carry at least $10,000 in PIP coverage, but most people don’t understand what this means for their case. Your PIP coverage pays 80% of medical bills and 60% of lost wages regardless of who caused the accident, but these benefits run out fast. The Florida Department of Highway Safety reports that average PIP claims reach $8,500 (which leaves many accident victims with thousands in unpaid medical bills when their coverage expires).

Your Insurance Policy Limits Matter More Than You Think

Most Florida drivers carry only the minimum $10,000 PIP coverage, which covers just two weeks in a hospital. Check your policy declarations page right now because many people discover too late that they have inadequate coverage. Uninsured motorist coverage protects you when the at-fault driver has no insurance, which affects 20% of Florida drivers according to state insurance commission data. Victims lose $50,000 or more because they skip this optional coverage that costs less than $200 per year.

When You Can Break Florida’s No-Fault Rules

Florida law allows you to sue the other driver only when your injuries meet the serious injury threshold, which includes permanent injury, significant scarring, or death. Medical bills that exceed your PIP limits automatically qualify you to pursue additional compensation from the at-fault driver’s insurance. The key lies in proper medical documentation because insurance companies fight these claims aggressively. Soft tissue injuries rarely qualify unless they cause permanent limitations, but broken bones, herniated discs, and surgical repairs almost always meet the threshold.

Taking Action Against the Other Driver’s Insurance

You can file a liability claim against the other driver’s insurance even while you use your own PIP benefits. Their insurance company will investigate fault and may offer a settlement, but never accept their first offer because it typically covers only 30-40% of actual damages according to insurance industry studies. Property damage claims operate separately from injury claims (so you can get your car fixed while you negotiate your injury settlement).

However, insurance companies often employ tactics to minimize payouts, which leads many accident victims to make costly mistakes that can destroy their cases. Understanding your rights after a car crash becomes crucial when navigating these complex insurance negotiations.

Common Mistakes That Hurt Your Case

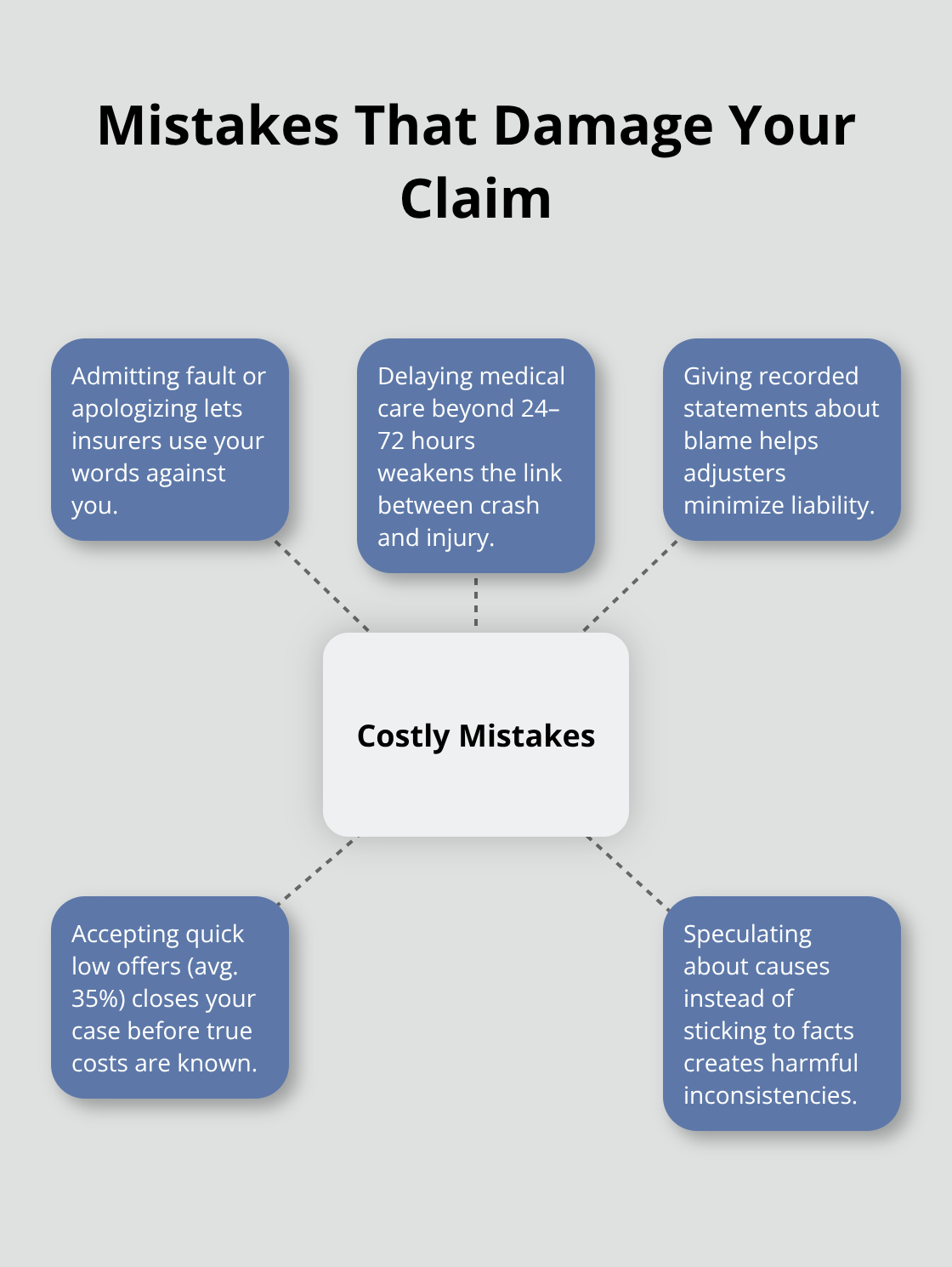

Insurance companies win cases because accident victims make predictable errors that destroy their claims before lawyers get involved. The most damaging mistake happens within minutes of the crash when people apologize or say they caused the accident. Florida courts treat any admission of fault as evidence against you, even when you made the statement while confused or in shock after impact. Insurance adjusters record phone calls and use your own words to deny claims worth tens of thousands of dollars. State your name and basic facts but never discuss what happened or who you think caused the crash.

Admitting Fault Destroys Your Case Immediately

Any statement that suggests responsibility becomes evidence against you in court proceedings. Insurance companies train their adjusters to ask leading questions that trick accident victims into accepting blame during recorded phone calls. Even saying “I’m sorry” can be interpreted as an admission of guilt under Florida law. Police officers determine fault through investigation and evidence (not through your emotional reactions at the scene). Stick to factual observations about what you saw and felt without speculating about causes or responsibility.

Medical Treatment Delays Kill More Claims Than Anything Else

Medical treatment delays kill more injury claims than any other factor because insurance companies argue that gaps in treatment prove your injuries came from something else. The American Medical Association found that soft tissue injuries appear 24-48 hours after accidents, but waiting longer than 72 hours to seek care gives insurers ammunition to deny your claim entirely. Emergency room visits within 24 hours create undisputable medical records that establish the connection between your accident and injuries. Skip the doctor for a week and insurance companies will argue you got hurt at home, work, or during recreational activities instead of in the crash.

Quick Settlement Offers Target Desperate Victims

Insurance companies make quick settlement offers because they know medical bills and lost wages increase over time. The average initial settlement offer covers only 35% of actual damages according to insurance industry data, but these lowball offers come with tight deadlines designed to pressure you into accepting inadequate compensation. Once you sign a release and cash their check, you cannot pursue additional money even when doctors discover serious injuries weeks later. Most accident injuries require 3-6 months of treatment to reach maximum medical improvement (so any settlement offer within 30 days of your accident almost guarantees you will lose money).

Final Thoughts

Motor vehicle accidents change lives in seconds, but your actions afterward determine your financial recovery for years. Proper documentation prevents 60% of disputed claims, while treatment delays destroy more cases than any other factor. Insurance companies use every mistake against you to minimize their payouts.

We at Harnage Law PLLC have seen accident victims lose thousands of dollars because they lacked proper motor vehicle accident legal advice from day one. The difference between a successful claim and a denied one often comes down to experienced legal representation who understands Florida’s complex insurance laws. Insurance companies employ teams of adjusters and lawyers whose job involves minimizing payouts (and they count on accident victims making predictable mistakes).

Your case deserves aggressive representation that fights insurance company tactics while you focus on recovery. Contact Harnage Law PLLC for the legal guidance you need after your accident. We handle the insurance companies so you can concentrate on getting better.