How to Get a Divorce in California

Our Blog

How to Get a Divorce in California

Divorce in California involves specific legal steps, timelines, and financial considerations that many people find overwhelming. At Harnage Law PLLC, we’ve guided countless clients through this process and understand the complexity involved.

This guide walks you through filing requirements, property division rules, and child custody decisions. You’ll find practical information to help you move forward with confidence.

Filing for Divorce in California

Understanding Residency Requirements

California’s divorce process starts with understanding the residency requirements that determine where and when you can file. You must have lived in California for at least six months and in the specific county where you’re filing for at least three months. This requirement prevents people from filing divorce papers in a state where they have no real connection. If you don’t meet these requirements yet, you have options: file for legal separation first and convert it to a divorce once you satisfy the residency rules, or wait until you meet the timeline.

The Waiting Period That Affects Your Timeline

The mandatory six-month waiting period begins after your spouse receives the divorce papers, not when you file them. This means the earliest your divorce can be finalized is six months and one day after proper service occurs. If service gets delayed, your timeline extends accordingly. Understanding this distinction matters because many people mistakenly count the waiting period from their filing date rather than the service date.

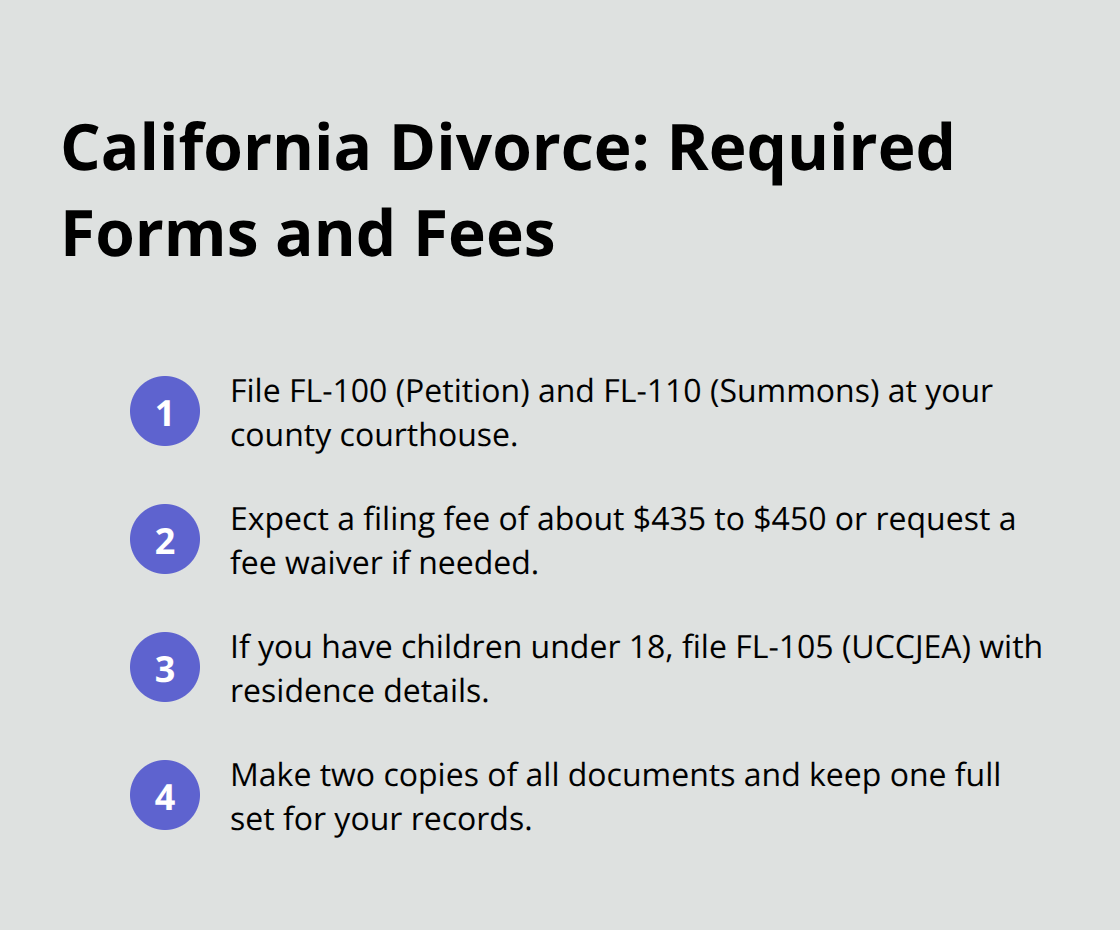

Required Forms and Filing Fees

Starting a California divorce requires filing the Petition for Marriage or Domestic Partnership (form FL-100) along with the Summons (form FL-110) at your county courthouse. The filing fee runs approximately $435 to $450, though you can request a fee waiver if you cannot afford it. If you have children under eighteen, you must also file the Declaration under Uniform Child Custody Jurisdiction and Enforcement Act (form FL-105) to inform the court where your children live. Make two copies of everything before submitting to the court, keeping one set for your records.

Once filed, your spouse becomes the respondent and has thirty days to respond after being officially served. The Standard Family Law Restraining Orders take effect automatically upon filing, prohibiting you from removing children from California, transferring assets, changing insurance beneficiaries, or hiding money without court approval or your spouse’s written agreement. Violating these automatic orders can result in serious consequences, even before your case reaches trial.

Serving Your Spouse With Divorce Papers

Service of divorce papers is not optional and not something you can do yourself. An adult who is not a party to the case must personally deliver the documents to your spouse or use certified mail with a return receipt. The court requires proof of service filed with the court, documented on form FL-335 for mail service or form FL-330 for personal delivery. Without proper service, your spouse has no legal notice that the case has begun, and the court cannot proceed.

If your spouse cannot be located, you may petition the court for alternative service methods, but this adds time and complexity to your case. Many people underestimate how critical service timing is, since the six-month waiting period does not begin until service is complete and documented with the court. Once you complete service properly, you move into the next phase of your divorce: gathering financial information and determining how property and assets will be divided.

How California Divides Property and Assets During Divorce

Understanding Community Property Law

California treats property division fundamentally differently than most other states. The state operates under community property law, which means any assets or debts accumulated during your marriage belong equally to both spouses, regardless of who earned the money or whose name appears on the account. This 50-50 split applies to income, real estate, vehicles, retirement accounts, and business interests acquired after your marriage date. Property owned before marriage or received as a gift or inheritance remains separate property and does not get divided.

The distinction matters enormously because misclassifying assets can cost tens of thousands of dollars.

Disclosing All Financial Information

You must complete a Schedule of Assets and Debts form FL-142 or Property Declaration form FL-160 listing everything with estimated values, and both spouses must disclose all financial information within 60 days of filing. Many people fail to report accounts their spouse doesn’t know about or undervalue property to gain an advantage, but courts discover these omissions through bank statements, tax returns, and third-party verification. Full transparency protects you from penalties and ensures the court makes decisions based on accurate information.

Handling Retirement Accounts Correctly

Retirement accounts require special attention because dividing them incorrectly triggers immediate tax penalties. If your spouse earned a 401k or pension during the marriage, you cannot simply withdraw half without consequences. Instead, you need a Qualified Domestic Relations Order or QDRO-a court document that instructs the retirement plan administrator to split the account without triggering early withdrawal penalties or taxes. IRAs can be divided more simply through a direct transfer or rollover without a QDRO, but the timing and method matter for tax purposes.

Valuing Business Assets and Complex Property

Business assets present even greater complexity because their value depends on multiple factors including revenue, profit margins, equipment, client lists, and market conditions. If you or your spouse owns a business, you should obtain a professional business valuation rather than guessing at worth, since courts rely on documented valuations during disputes. A professional appraiser provides the documentation courts need to make fair decisions about business division.

Negotiating Settlement Agreements

Negotiating a settlement agreement before trial preserves your control over how assets get divided and avoids the unpredictability of a judge’s decision. A written agreement memorialized in a final Judgment form FL-180 typically costs far less than litigation and resolves your case faster. Many divorcing couples split assets 50-50 as community property law requires, but you can negotiate different arrangements if both parties agree-perhaps one spouse keeps the house while the other receives retirement accounts or business interests of equivalent value. Once you and your spouse reach agreement on property division, you must address another critical component of your divorce: determining custody arrangements and support obligations for any children involved in the case.

Child Custody and Support Arrangements

Legal and Physical Custody in California

Custody decisions in California divorce cases carry more weight than property division because they directly affect your children’s lives and your relationship with them going forward. California courts recognize two primary forms of custody: legal custody, which gives a parent the right to make major decisions about education, healthcare, and religion, and physical custody, which determines where children live day-to-day. Most California courts now favor joint legal custody, meaning both parents share decision-making authority even if one parent has primary physical custody. The state’s preference for maintaining meaningful relationships with both parents has shifted away from winner-take-all custody arrangements.

Mediation and the Custody Process

If you and your spouse cannot agree on custody, the court will order Child Custody Recommending Counseling mediation in most counties, and the counselor’s report heavily influences the judge’s final decision. Attending this mediation seriously and presenting a realistic parenting plan matters far more than aggressive courtroom tactics, since judges prioritize stability and the child’s best interests over parental preferences. The mediator evaluates each parent’s relationship with the child, work schedules, and ability to support the child’s connection to the other parent.

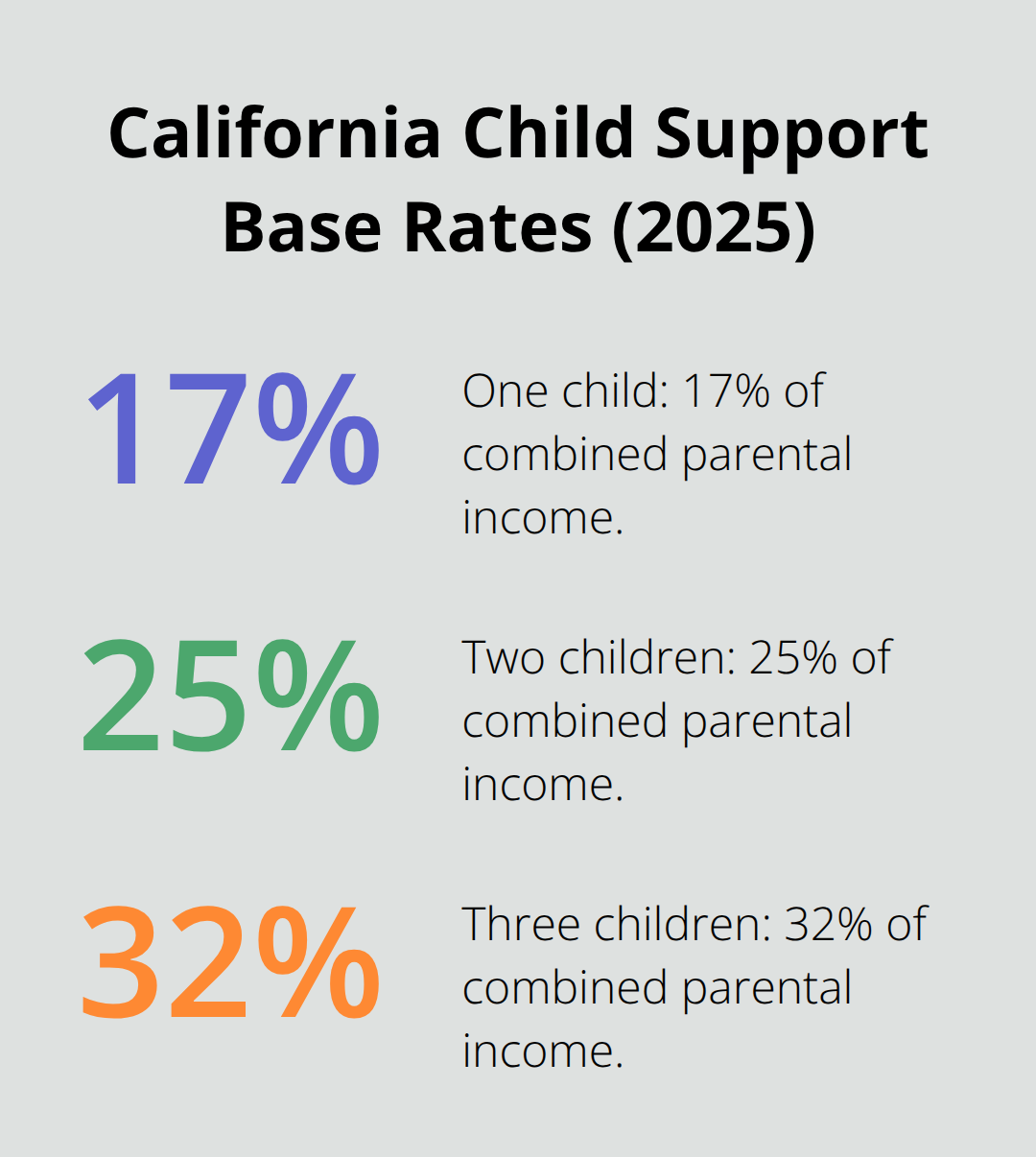

How California Calculates Child Support

Child support calculations in California follow a strict formula established by state law, not judicial discretion. The court uses the combined parental income, the percentage of time each parent spends with the child, and statutory percentages set by California to determine monthly support obligations. For 2025, California applies a base support rate of 17 percent of combined parental income for one child, 25 percent for two children, 32 percent for three children, 40 percent for four children, and 50 percent for five or more children. This formula applies to income up to $250,000 annually, with adjustments required for higher earners.

Self-Employment and Income Documentation

Self-employed parents face scrutiny regarding actual income versus claimed deductions, so maintain detailed business records and tax returns. Courts examine profit-and-loss statements, business tax returns, and personal tax returns to verify reported income. Inconsistencies between what you claim for tax purposes and what you report for child support calculations can result in penalties and increased support obligations.

Modifying Custody and Support Orders

Modifying custody or support orders after divorce requires showing a substantial change in circumstances, such as a significant job loss, relocation, or material change in the child’s needs. Courts will not modify orders simply because circumstances shifted slightly or because one parent wants a different arrangement. The burden falls on the parent requesting modification to prove the change justifies overturning the existing order.

Final Thoughts

Your California divorce is now legally complete, but the practical work of rebuilding your life continues. The six-month waiting period has passed, your assets are divided, and custody arrangements are finalized. You must complete several administrative tasks to protect your financial security and prevent future complications.

Update your estate planning documents immediately after divorce. Remove your former spouse as a beneficiary from your will, revoke any powers of attorney naming them, and update life insurance beneficiaries to prevent your ex from inheriting assets you intended for your children or other family members. Contact the plan administrator if a QDRO was issued for your 401k or pension to confirm the split was processed correctly, and verify that any IRA divisions created new accounts in your name alone.

Property transfers require formal documentation to finalize ownership changes. If you kept the family home, refinance the mortgage to remove your ex’s name and update the deed, then visit your local DMV to transfer vehicle titles. When complexity exceeds your comfort level-particularly with substantial assets, business interests, or custody disputes-we at Harnage Law PLLC provide representation to handle the legal details so you can focus on moving forward. Contact us to discuss your situation and learn how to get a divorce in California with professional guidance.