How to Navigate Military Divorce Laws and Requirements

Our Blog

How to Navigate Military Divorce Laws and Requirements

Military divorce laws present unique challenges that civilian divorces don’t face. Active duty, deployments, and military benefits create a complex legal landscape that requires careful navigation.

At Harnage Law PLLC, we understand how military service affects property division, custody arrangements, and financial obligations. This guide walks you through the key issues you’ll encounter in a military divorce.

Where Can You File for Military Divorce

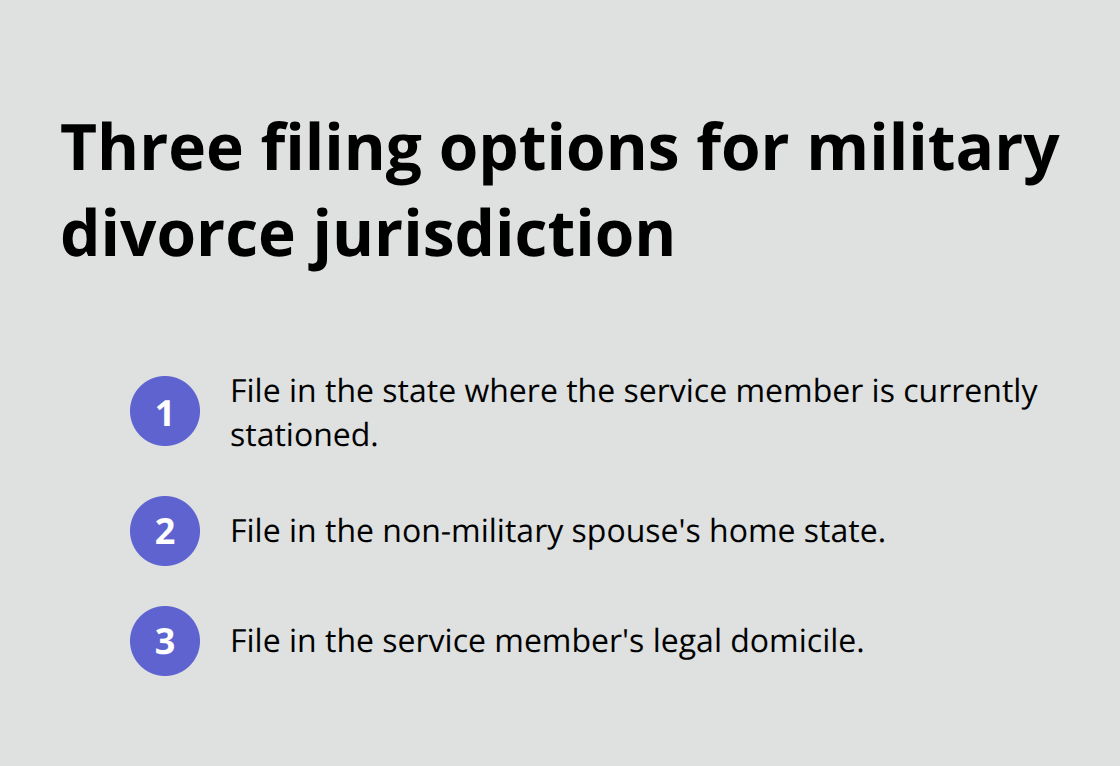

Jurisdiction determines which court handles your military divorce, and this choice carries real consequences for property division, spousal support, and custody outcomes. You have three primary filing options: the state where the service member is stationed, the non-military spouse’s home state, or the service member’s legal domicile. Each jurisdiction has different residency requirements and applies different state laws to your case. Some states require 90 days of residency before filing, while others demand six months.

How SCRA Protects Active-Duty Service Members

The Servicemembers Civil Relief Act, passed by Congress, gives active-duty service members a protective shield during divorce proceedings. Under this law, if a service member cannot participate in court due to active-duty obligations, they can request a stay that typically lasts 90 days and can be extended further. This protection prevents a default judgment against them while deployed or stationed far from home, ensuring they have a fair chance to respond to the divorce filing.

State Laws Shape Your Outcome

State jurisdiction matters because divorce law varies significantly across the country. Property division, spousal support calculations, and child custody standards all depend on which state’s laws apply to your case. Filing in the non-military spouse’s home state sometimes provides a tactical advantage because local courts and resources are familiar with that jurisdiction’s rules.

A service member can maintain legal domicile in one state while stationed in another, creating additional flexibility in where you file. The interplay between federal military law and state family law requires careful consideration. Evaluate your specific circumstances, including where assets are located, where children attend school, and which state’s laws most favor your position. This analysis should happen before you file, not after.

Federal and State Court Roles

Federal courts do not typically handle military divorces; state courts apply federal protections like the Servicemembers Civil Relief Act while following their own state’s family law rules. Understanding how your state treats military retirement pay, spousal support, and custody will shape the entire direction of your case. The timing of your filing and the jurisdiction you select work together to influence outcomes that affect decades of your life. With multiple filing options available and different legal frameworks at play, the next section examines how military retirement pay divides under federal law and state court orders.

How Military Retirement Pay Divides in Divorce

Understanding the Core Rule

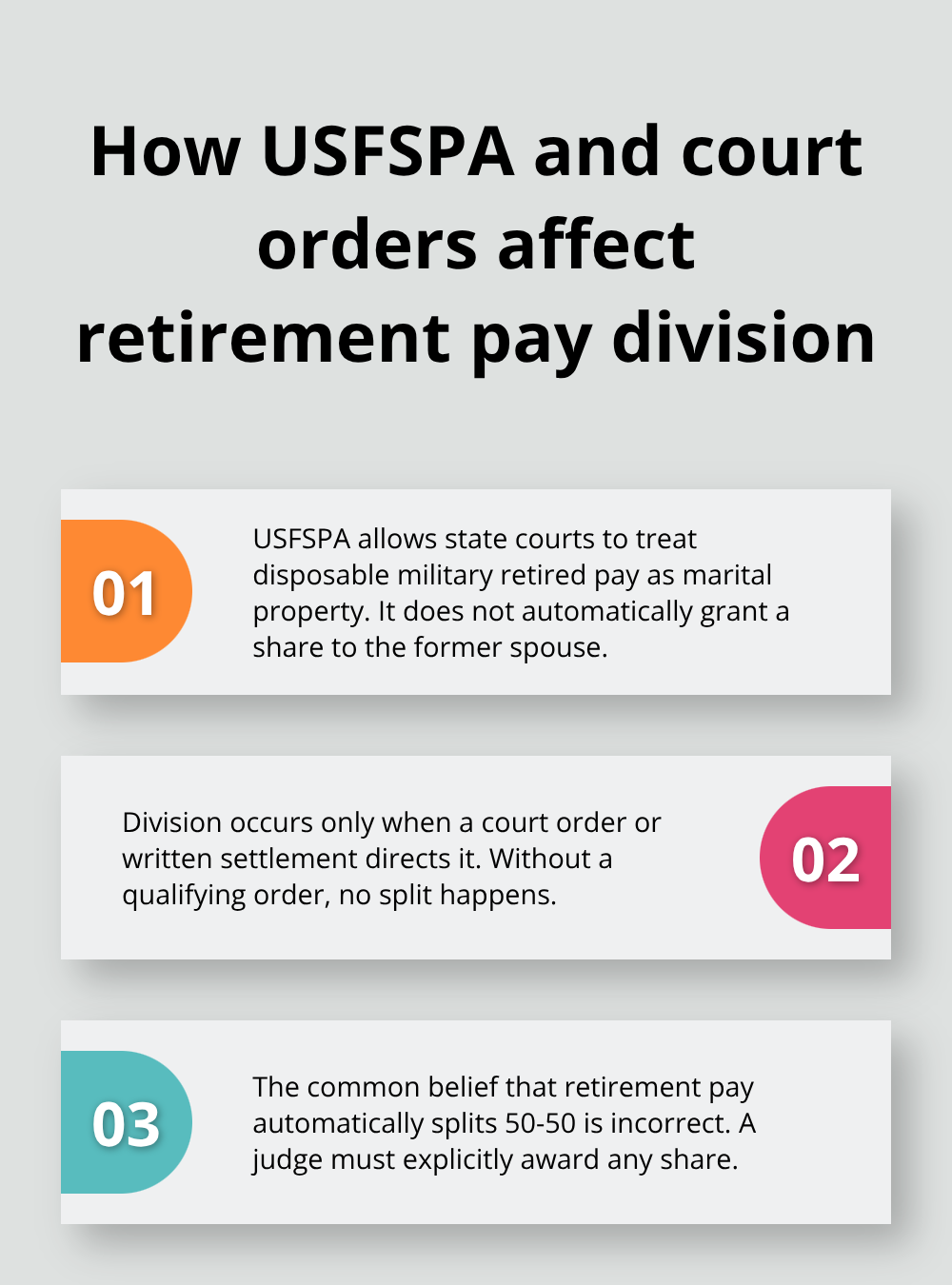

Military retirement pay ranks among the most valuable assets in a service member’s life, and it becomes a central battleground in divorce cases. The Uniformed Services Former Spouses’ Protection Act governs how state courts treat disposable military retired pay as marital property, but the law does not automatically entitle a former spouse to a share. A court order or written agreement must exist before any division occurs. This distinction matters tremendously because many service members believe retirement pay automatically splits fifty-fifty, when in reality the court must explicitly award it.

How Payment Actually Works

The Defense Finance and Accounting Service will only direct-pay a former spouse if a valid court order exists that meets federal requirements. If no order is in place, the service member controls all payments and bears full responsibility for sending money to their former spouse, creating enforcement problems down the line. Calculate the actual value of retirement pay by understanding that it includes base pay plus allowances such as Basic Allowance for Housing and Basic Allowance for Subsistence, not just the salary figure. Many former spouses underestimate what they should receive because they fail to account for these substantial allowances that significantly increase monthly income.

The Ten-Year Rule and Direct Payment

The ten-year overlap rule represents one of the most misunderstood provisions in military divorce law. If the marriage overlapped with military service for at least ten years, the Defense Finance and Accounting Service can direct-pay the former spouse their share without the service member acting as intermediary. This protection eliminates collection headaches and guarantees consistent payments. However, this rule applies only to payment mechanics, not to whether a former spouse deserves a share in the first place.

Additional Benefits and Long-Term Value

Survivor Benefit Plan coverage and VA disability compensation add complexity that requires careful negotiation in settlement agreements. VA disability compensation never divides as marital property under federal law, but courts sometimes offset this by awarding larger shares of retirement pay to the non-military spouse. Some former spouses retain valuable benefits like TRICARE health coverage and commissary privileges if they meet the twenty-twenty-twenty rule (the marriage must overlap twenty years with service, and the former spouse must have been married to the service member for twenty years). Verify your eligibility status with your attorney before finalizing any settlement, as these benefits hold substantial long-term financial value that many people overlook when calculating the true worth of their divorce agreement. Understanding these layered protections and benefit structures sets the stage for navigating child custody arrangements, which present their own distinct challenges when military deployments and relocations enter the picture.

Child Custody and Deployment

How Deployment Affects Custody Arrangements

Military deployment fundamentally changes how courts approach custody arrangements, and the Uniform Deployed Parents Custody and Visitation Act protects service members from losing custody solely because of upcoming deployment. Courts prioritize the child’s best interests above all else, which means deployment alone cannot trigger an automatic custody shift to the other parent. However, you must prepare a detailed parenting plan that addresses deployment realities, including who cares for the children during active duty, how communication happens across time zones, and what happens when the service member returns. Courts expect specifics here, not vague promises.

Creating a Deployment-Ready Parenting Plan

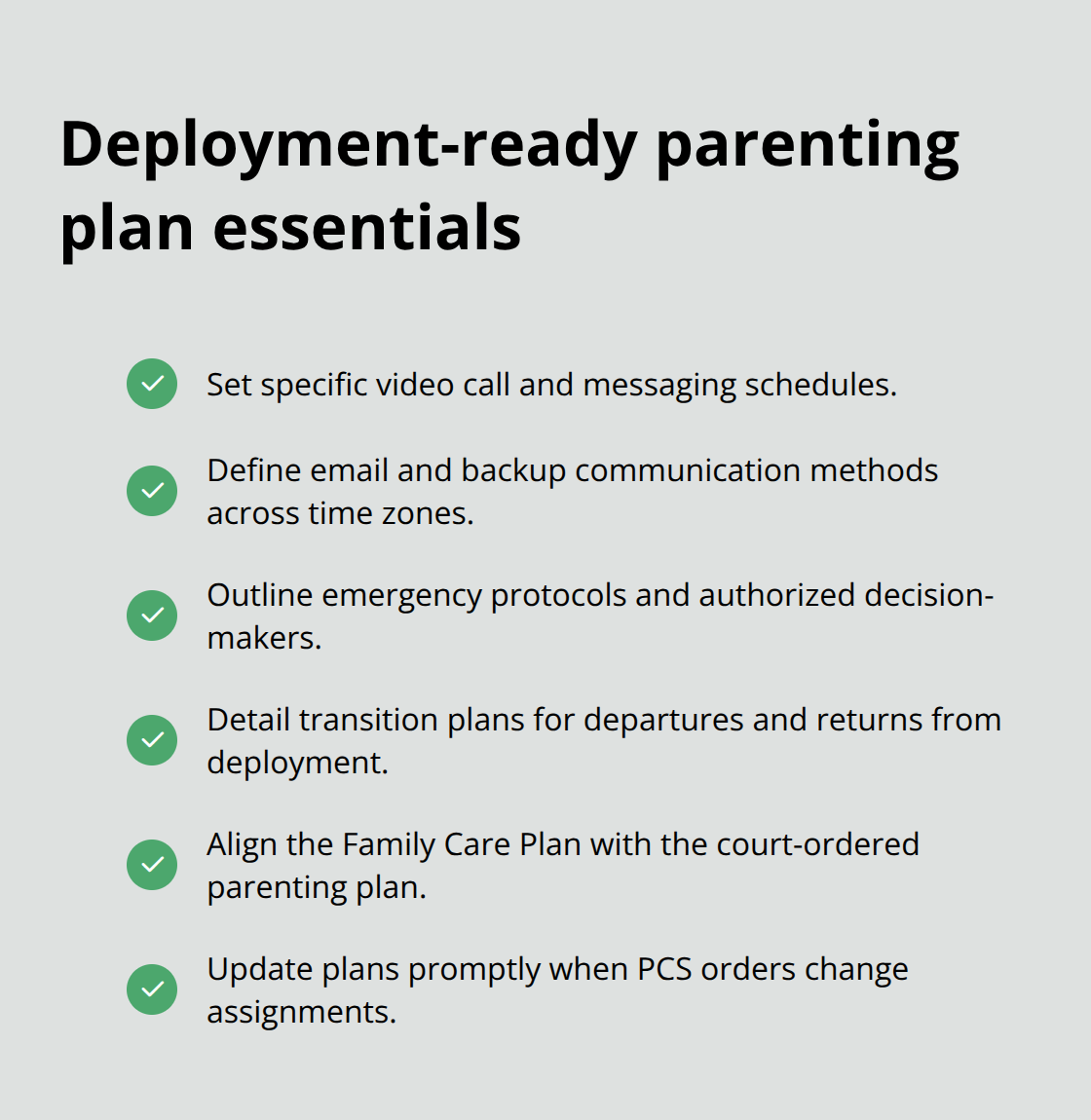

Document everything in writing: video call schedules, email contact methods, emergency protocols, and how transitions will occur. The Family Care Plan complements the court order by designating a caregiver during deployment, detailing financial support arrangements, transportation logistics, and death contingencies. This plan must align perfectly with your parenting plan because inconsistencies create enforcement problems and signal to judges that you haven’t thought through the practical realities of military life. Many parents fail to update these plans when PCS orders arrive, which forces expensive modifications later.

Treat deployment planning as a living document that changes with military assignments, not a one-time filing.

Military Moves and Jurisdiction

When a service member receives PCS orders to relocate, the Uniform Child Custody Jurisdiction and Enforcement Act determines which state maintains jurisdiction over custody matters, preventing conflicting orders across state lines. Military moves and income calculations present separate challenges that directly impact child support amounts and custody stability. You must calculate child support by adding base pay plus Basic Allowance for Housing and Basic Allowance for Subsistence to the service member’s total income, not just salary. Many parents and judges underestimate support obligations by ignoring these allowances, which can add thousands monthly to the calculation.

Income Calculations and Support Obligations

State guidelines apply these figures to determine support amounts, but military income presents complications because allowances vary by location and duty status. A service member stationed in San Diego receives different housing allowances than one in rural Oklahoma, yet both must pay support based on their actual total income. Courts recognize that deployment, relocations, and unpredictable military schedules create instability for children, so your parenting plan must build in flexibility while maintaining consistency. Joint custody remains the default unless abuse, addiction, or abandonment exists, because courts understand that children benefit from ongoing relationships with both parents despite military service.

Final Thoughts

Military divorce laws demand attention to federal protections, state jurisdiction rules, and the unique financial realities of military service. The Servicemembers Civil Relief Act shields active-duty service members from default judgments, the Uniformed Services Former Spouses’ Protection Act governs retirement pay division, and the Uniform Deployed Parents Custody and Visitation Act prevents deployment from becoming the sole reason to strip custody rights. These three federal frameworks work alongside your state’s family law rules to shape outcomes that affect your finances, your relationship with your children, and your long-term security.

The stakes in military divorce cases run high because retirement pay represents decades of accumulated value, custody arrangements determine how often you see your children, and child support calculations must account for allowances that significantly exceed base salary. Filing in the wrong jurisdiction, failing to secure a proper court order for retirement pay division, or neglecting to build deployment flexibility into your parenting plan creates problems that cost thousands to fix later. Many service members and former spouses navigate these cases without understanding that military divorce laws operate differently than civilian divorce rules, leading to settlements that leave money on the table or custody arrangements that collapse when the next PCS order arrives.

We at Harnage Law PLLC handle sensitive family law cases including divorce and child custody matters where strategic counsel makes the difference between outcomes that protect your interests and those that leave you vulnerable. The interplay between federal military law and state family law requires someone who understands both systems and can identify which jurisdiction serves your position best. Schedule a consultation with an attorney who handles military divorces to discuss your specific circumstances, evaluate filing options, and understand what retirement pay division, custody arrangements, and child support calculations will actually look like in your case.