How to Get an Uncontested Divorce in Texas

Our Blog

How to Get an Uncontested Divorce in Texas

An uncontested divorce in Texas can save you thousands of dollars and months of court battles. When both spouses agree on the major issues, the process moves faster and costs significantly less than a contested divorce.

At Harnage Law PLLC, we help clients navigate this streamlined path with confidence. Understanding the specific steps and requirements in Texas makes all the difference in protecting your interests.

What Counts as Truly Uncontested

An uncontested divorce means you and your spouse have reached genuine agreement on every material issue before filing with the court. This is not the same as a no-fault divorce, which simply means neither spouse blames the other for the marriage ending. Texas Family Code 6.001 allows one spouse to obtain a divorce even if the other opposes it, making no-fault divorces common. However, uncontested divorces require far more: complete alignment on property division, debt allocation, and if children are involved, custody and support arrangements. Many people confuse these concepts and assume that filing on no-fault grounds automatically makes their case uncontested. That misunderstanding can lead to costly surprises when disagreements emerge during the process.

When Agreement Actually Exists

True agreement means your settlement covers every asset, every debt, and every obligation the court would otherwise decide. Texas is a community property state, meaning property and debts acquired during the marriage are generally divided in a just and right manner, which courts interpret as roughly equal. If you own a house, retirement accounts, vehicles, credit cards, or business interests, you must have decided who gets what and who pays what. If children are under 18 or still in high school, you must have finalized custody arrangements, visitation schedules, child support amounts, and healthcare decision-making authority. The Texas State Law Library emphasizes that true uncontested cases typically involve no minor children or complete agreement on every parenting detail. Incomplete agreements on even one issue transform your case from uncontested to contested, triggering formal hearings and attorney involvement.

Red Flags That Signal a Contested Path Ahead

Certain situations almost guarantee your divorce will become contested despite initial intentions. Complex estates with significant assets, retirement accounts that require a Qualified Domestic Relations Order, real property ownership, ongoing business interests, or bankruptcy proceedings make agreement far harder to maintain. If one spouse earns substantially more than the other and you have not settled spousal maintenance, disagreement is likely. If either spouse fears for safety or has obtained a protective order, the case requires different handling altogether. If you have any uncertainty about what your spouse actually owns, whether hidden accounts exist, or whether full financial disclosure has occurred, your case is not truly uncontested. Discovering undisclosed assets or debts midway through the process creates serious legal and financial consequences that affect your settlement and timeline.

Moving Forward With Confidence

Verify complete financial transparency before treating a divorce as uncontested. Both spouses must disclose all bank accounts, investment statements, property titles, and debt obligations. Full disclosure protects both parties and prevents costly disputes later. Once you confirm that genuine agreement exists on all material issues, you can move forward with filing the required documents and navigating Texas’s specific procedural requirements.

Filing Your Divorce Documents in Texas

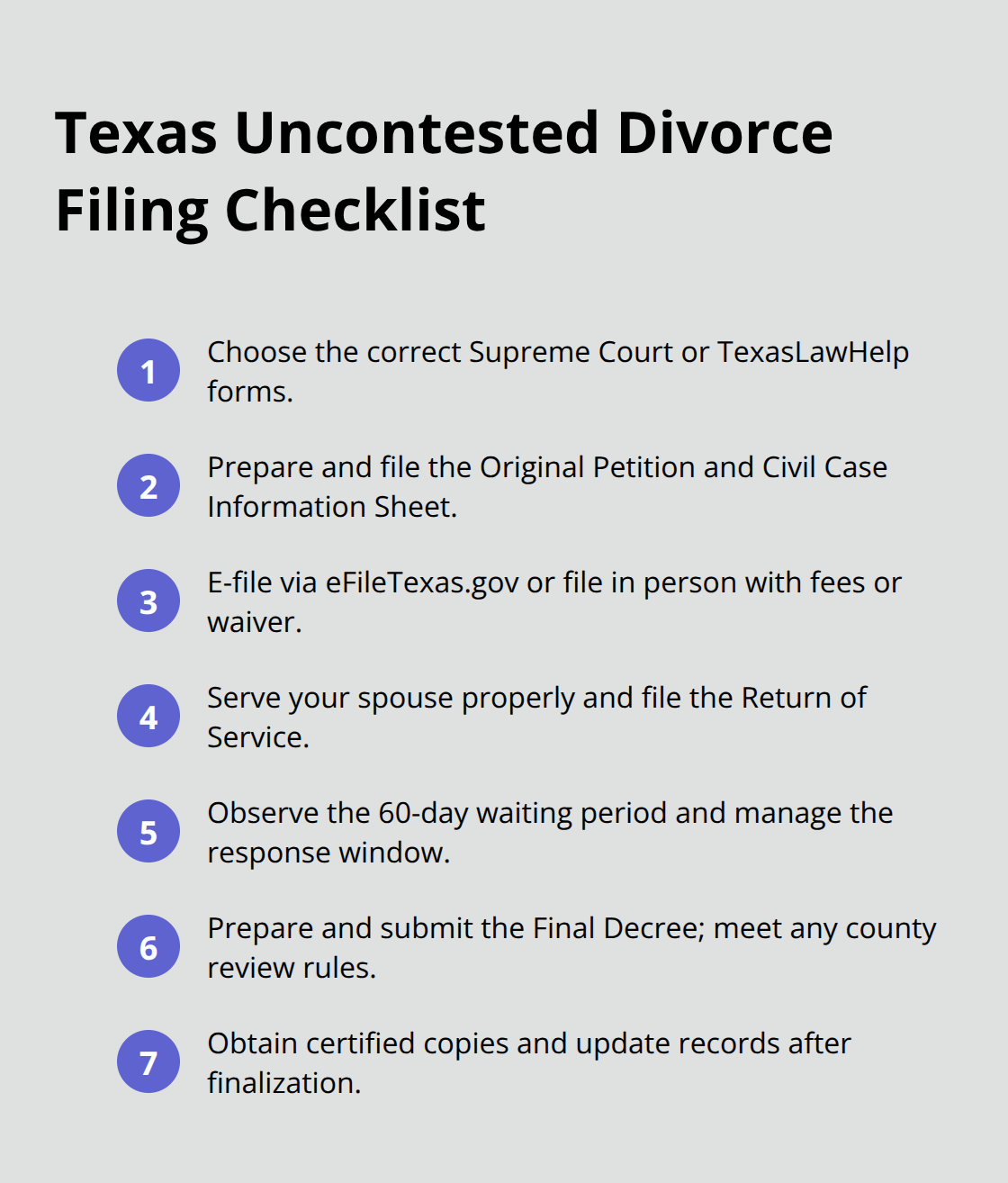

Gather and Prepare the Required Forms

Texas has one official divorce form approved by the Supreme Court of Texas. For uncontested divorces without children and without real property, you’ll use the Supreme Court-approved Divorce Forms for No Children, No Property. If your situation includes minor children or real property, TexasLawHelp.org provides free toolkits with the exact forms and step-by-step instructions you need. You’ll file an Original Petition for Divorce along with a Civil Case Information Sheet if filing in person. Filing fees vary by county but typically range from $150 to $300 according to county clerk information. If you cannot afford these costs, you can file an Affidavit of Inability to Pay Court Costs to request a waiver.

E-filing through eFileTexas.gov offers guided interviews that help you create your forms at no cost, though standard filing fees still apply. The guided interview walks you through the Start a Filing and Family Cases section, making the process straightforward even without a lawyer. Once you’ve prepared your settlement agreement detailing how you’ll divide all property, debts, and custody arrangements (if applicable), include this in your filing.

Serve Your Spouse and File the Return of Service

Your spouse must receive a copy of the petition through proper service, which a constable, sheriff, or process server can handle. The Return of Service document proving your spouse was served must be filed with the court and kept on file for at least 10 days before you can finalize the divorce. This step protects both parties and creates an official record that your spouse received notice of the proceedings.

Navigate the Mandatory Waiting Period and Response Window

Texas requires a mandatory 60-day waiting period from the filing date before your divorce can be finalized, though this waiting period can be waived if family violence occurred or a protective order exists. During this waiting period, your spouse has until 10:00 A.M. on the Monday after 20 days from service to file a response. If your spouse agrees to the terms, they can sign an Answer or waive service entirely, which speeds the process considerably.

Submit the Final Decree and Handle Special Requirements

Once the 60-day period passes and both parties have signed the Final Decree of Divorce, you can submit it to the judge for signature. Some Texas counties require attorney review of the Final Decree before the judge will sign it, so check your specific county’s local standing orders. Many uncontested cases avoid court appearances altogether, though some judges require brief testimony or affidavits to prove the terms are accurate and fair.

If you’re dividing retirement benefits like pensions or 401k accounts, you’ll need a Qualified Domestic Relations Order prepared before the hearing, which the employer or plan administrator can help you draft. If your name is changing as part of the divorce, file an Order Restoring Name Used Before Marriage to revert to a prior name, then update your Social Security Administration records, driver’s license, voter registration, passport, and any property titles or deeds accordingly.

Finalize and Obtain Certified Copies

After the judge signs the Final Decree, file it with the clerk and obtain certified copies for your records. These certified copies serve as proof of your divorce and become necessary when updating government agencies and financial institutions. With your Final Decree in hand, you’re ready to address the financial and legal considerations that protect your interests moving forward.

Protecting Your Financial Interests

Identify Community Property and Separate Assets

Texas community property law treats most assets and debts acquired during marriage as jointly owned, regardless of whose name appears on the title or account. Your house, retirement accounts, vehicles, and credit cards accumulated during the marriage typically belong to both spouses equally, even if one spouse earned all the income. The Texas Family Code requires division in a just and right manner, which courts interpret as roughly equal unless circumstances justify otherwise. However, separate property-assets owned before marriage, inheritances, or gifts to one spouse-remains off-limits during division.

Many people underestimate how much property they’ve accumulated and fail to identify what’s truly separate versus community. Before finalizing your settlement, create a comprehensive inventory of every asset and debt with acquisition dates and current values. Bank statements from before your marriage establish separate property claims, so gather these documents early. If you own real estate, pull the deed and mortgage documents to confirm when the property was purchased and whose name appears on the title.

Handle Retirement Accounts With Precision

Retirement accounts require particular attention because dividing them improperly triggers immediate tax consequences and forfeits benefits. A Qualified Domestic Relations Order handles this division correctly and protects both spouses from unexpected tax bills or lost pension benefits that can cost thousands of dollars later. The employer or plan administrator can help you draft the QDRO before your hearing concludes. Failing to use a QDRO when dividing retirement benefits creates permanent damage to your financial security that you cannot reverse after the divorce finalizes.

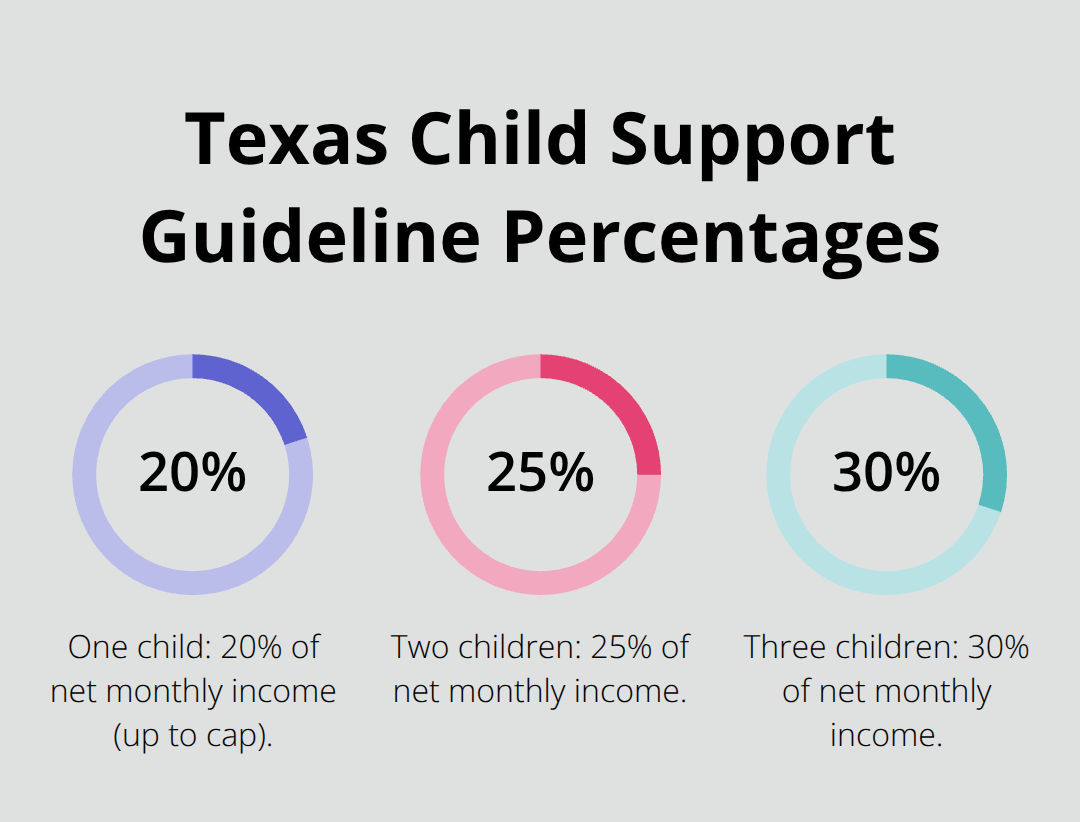

Calculate Child Support Obligations

Child support in Texas follows statutory guidelines based on the paying parent’s net monthly income, capped at $9,200 as of 2023. For one child, the guideline is 20 percent of net income; two children means 25 percent; three children means 30 percent, continuing up to 40 percent for five or more children. These percentages are not negotiable unless both parties document why the guidelines would be unjust or inappropriate for your specific situation.

Many people settle for less than guideline amounts or waive support entirely without understanding the long-term financial impact. Calculate what the guidelines require before negotiating downward, and understand that you cannot easily modify support orders later if circumstances change. If your spouse earns significantly more income than you, the difference between guideline support and a discounted settlement could amount to tens of thousands of dollars over several years.

Understand Spousal Maintenance Rules and Limits

Spousal maintenance differs significantly from child support-you can only receive it if the marriage lasted at least 10 years, or if you have a disability or lack sufficient property to meet your minimum needs. The maximum spousal maintenance is 20 percent of the paying spouse’s net monthly income, capped at $5,000 monthly. This support obligation carries different modification rules than child support, so understanding the distinction matters for your long-term financial planning.

Document All Income Sources Thoroughly

Document all income sources-W-2s, 1099s, business profits, rental income, bonuses-because incomplete income disclosure leads to underpayment and legal disputes that cost far more to resolve than getting it right initially. Your spouse must disclose every income stream, and you must verify these claims with actual documentation rather than accepting verbal statements. Incomplete financial transparency at this stage creates problems that haunt you for years after the divorce finalizes.

Final Thoughts

An uncontested divorce in Texas delivers real financial and emotional benefits when both spouses commit to genuine agreement. The process typically takes around six months from filing to finalization, compared to contested divorces that stretch over years and drain resources through litigation. Your costs drop dramatically-representing yourself may cost roughly $500 per person in filing fees, while working with an attorney typically runs at least $5,000 plus court costs.

The path forward requires careful attention to Texas-specific requirements that many people overlook. Missing a filing deadline, failing to serve your spouse properly, or submitting incomplete financial disclosures can transform your uncontested divorce Texas case into a contested one overnight. Retirement account divisions demand precision through a Qualified Domestic Relations Order, and child support calculations follow strict statutory guidelines that you cannot simply negotiate away.

Contact Harnage Law PLLC to discuss your situation and determine the right level of support for your circumstances. Whether you need full representation or limited-scope assistance with specific documents, having an attorney review your settlement agreement catches issues you might miss and prevents costly mistakes. Taking time now to get the details right saves you thousands of dollars and years of regret later.