Essential Legal Advice for Business Owners

Our Blog

Essential Legal Advice for Business Owners

Starting a business in Melbourne, Florida brings exciting opportunities alongside complex legal challenges. From choosing the right business structure to managing employment compliance, every decision impacts your company’s future success.

We at Harnage Law PLLC understand that navigating these legal requirements can feel overwhelming for new business owners. The right legal advice for business owners makes the difference between thriving and facing costly legal problems down the road.

Which Business Structure Protects Your Assets Best

Limited Liability Companies dominate Florida business formations for good reason. The Florida Department of State reports that LLCs account for over 70% of new business entity registrations annually. This structure shields personal assets from business debts while it offers tax flexibility that corporations cannot match.

Florida LLCs require only a registered agent and a filing fee of $125, which makes them accessible for small business owners. Unlike corporations, LLCs avoid double taxation since profits and losses flow directly to owners’ personal tax returns. The IRS allows single-member LLCs to elect corporate tax treatment if beneficial (providing options as your business grows).

Corporate Structure Creates Unnecessary Complexity

Corporations suit businesses that plan immediate public investment or require complex ownership structures. However, Florida corporations face mandatory annual reports that cost $150 plus registered agent fees. Corporate tax rates reach 21% federally, then owners pay personal taxes on dividends they receive.

This double taxation burden makes corporations inefficient for most small businesses. Florida partnerships expose all partners to unlimited personal liability, which creates dangerous financial risks. Smart business owners choose LLCs over partnerships every time. The Florida Small Business Development Center confirms that proper business formation prevents 40% of common legal disputes that sole proprietorships face when they operate without liability protection.

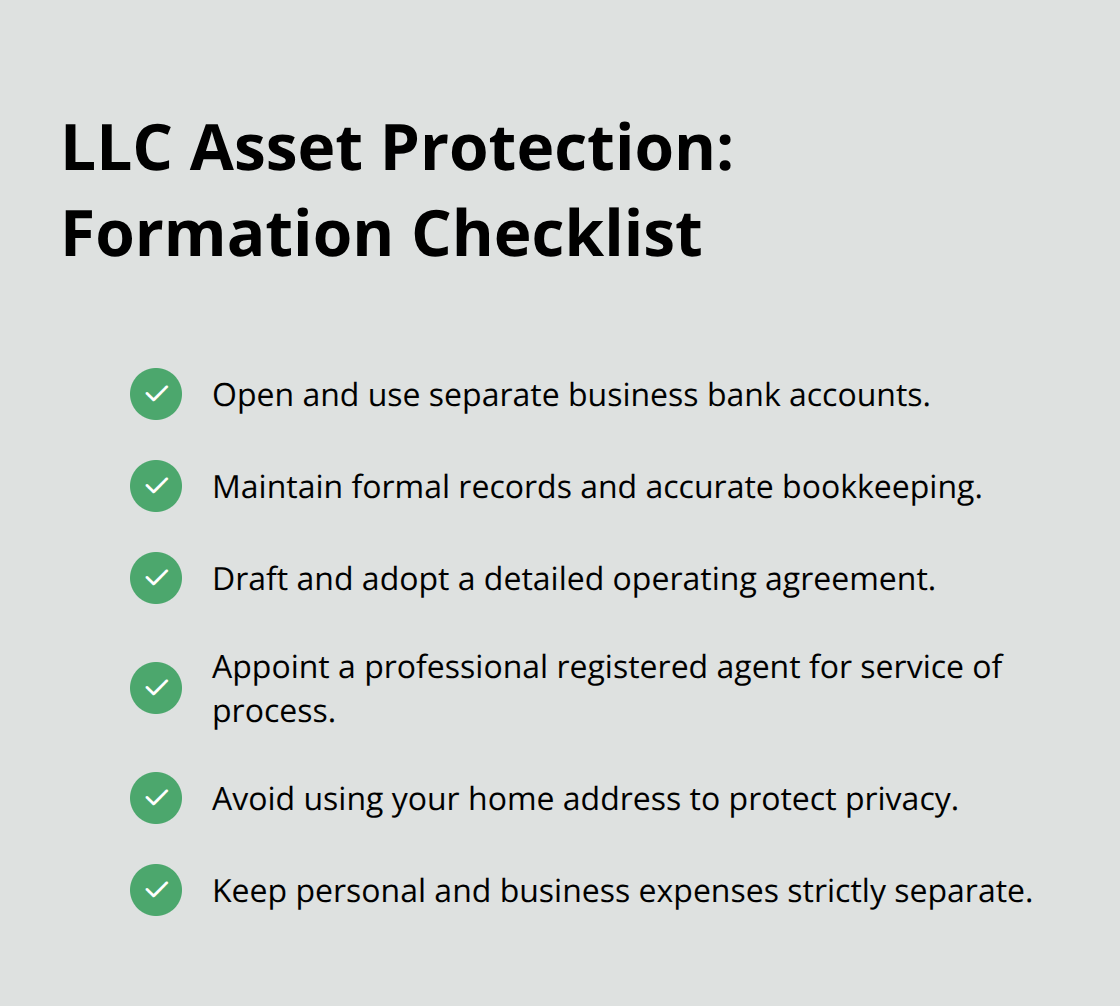

Asset Protection Requires Professional Formation

Business owners who file formation documents incorrectly void liability protection entirely. Florida courts regularly pierce corporate veils when businesses fail to maintain separate bank accounts or proper record-keeping. Business owners lose homes and personal savings because they treat their LLC like a personal checking account.

Professional formation includes operating agreements that define member roles, profit distribution, and decision-making authority. These agreements prevent costly disputes that destroy business partnerships. Florida requires LLCs to designate registered agents for legal service, and using your home address creates privacy risks (making professional registered agent services worthwhile).

Once you establish proper business formation, you must address the tax implications that each structure brings to your daily operations.

How Do You Avoid Costly Employment Law Violations

Florida employment law violations cost small businesses an average of $75,000 per incident according to the Equal Employment Opportunity Commission. Melbourne business owners face federal requirements under the Fair Labor Standards Act plus Florida-specific regulations that create compliance nightmares when ignored.

Employee handbooks must include mandatory policies on discrimination, harassment, wage calculations, and break periods that align with both federal and state standards. The Florida Commission on Human Relations requires businesses with 15 or more employees to maintain written anti-discrimination policies, while smaller businesses benefit from these protections anyway.

Wage Violations Destroy Small Business Cash Flow

The Department of Labor recovered $322 million in back wages for Florida workers in 2023. Most violations occurred in small businesses that miscalculated overtime or misclassified employees. Florida follows federal minimum wage at $12 per hour as of 2024, but overtime calculations become complex when employees work irregular schedules or receive tips.

Business owners who misclassify employees as independent contractors face penalties that average $50,000 per violation. You must track all hours worked, provide meal breaks for shifts over six hours, and calculate overtime at 1.5 times regular pay for any hours that exceed 40 per week. The FLSA requires businesses to maintain payroll records for three years (and missing documentation during audits results in automatic penalties).

Discrimination Claims Require Immediate Response Systems

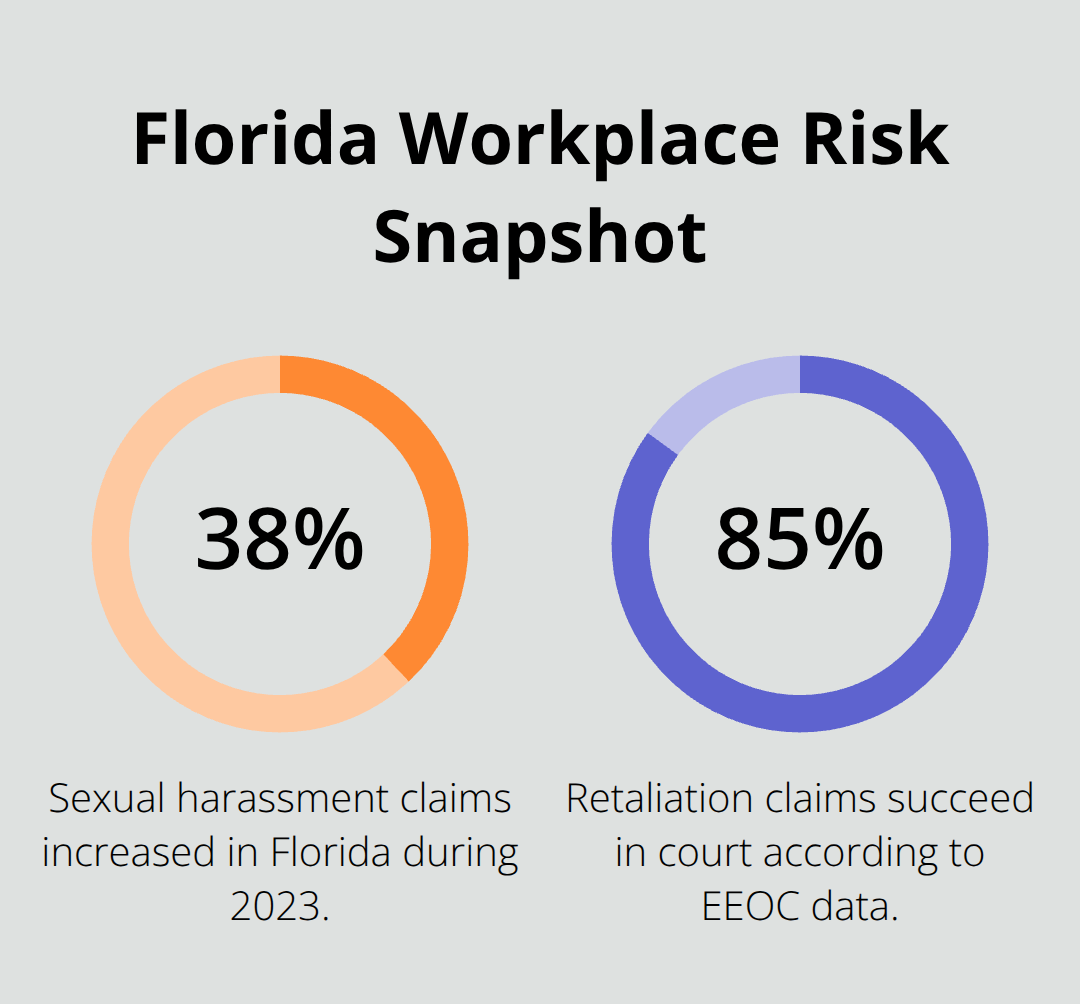

Sexual harassment claims increased 38% in Florida during 2023, with small businesses facing the highest settlement costs because they lack proper response procedures. Every business needs written complaint procedures that allow employees to report issues to multiple managers. This prevents situations where the harasser is the only supervisor available.

Anti-retaliation policies must explicitly protect employees who file complaints, as retaliation claims succeed in court 85% of the time according to EEOC data. You should train all managers on proper response protocols to prevent small issues from becoming federal lawsuits that cost six-figure settlements plus legal fees.

Documentation Standards Protect Against False Claims

Poor record maintenance leads to automatic liability in employment disputes. Courts assume employers violated wage laws when they cannot produce complete time records or policy acknowledgments. Smart business owners document every disciplinary action, performance review, and policy violation with dates and witness signatures (creating bulletproof defenses against wrongful termination claims).

Contract management becomes your next line of defense once you establish solid employment practices that protect both your business and your workers.

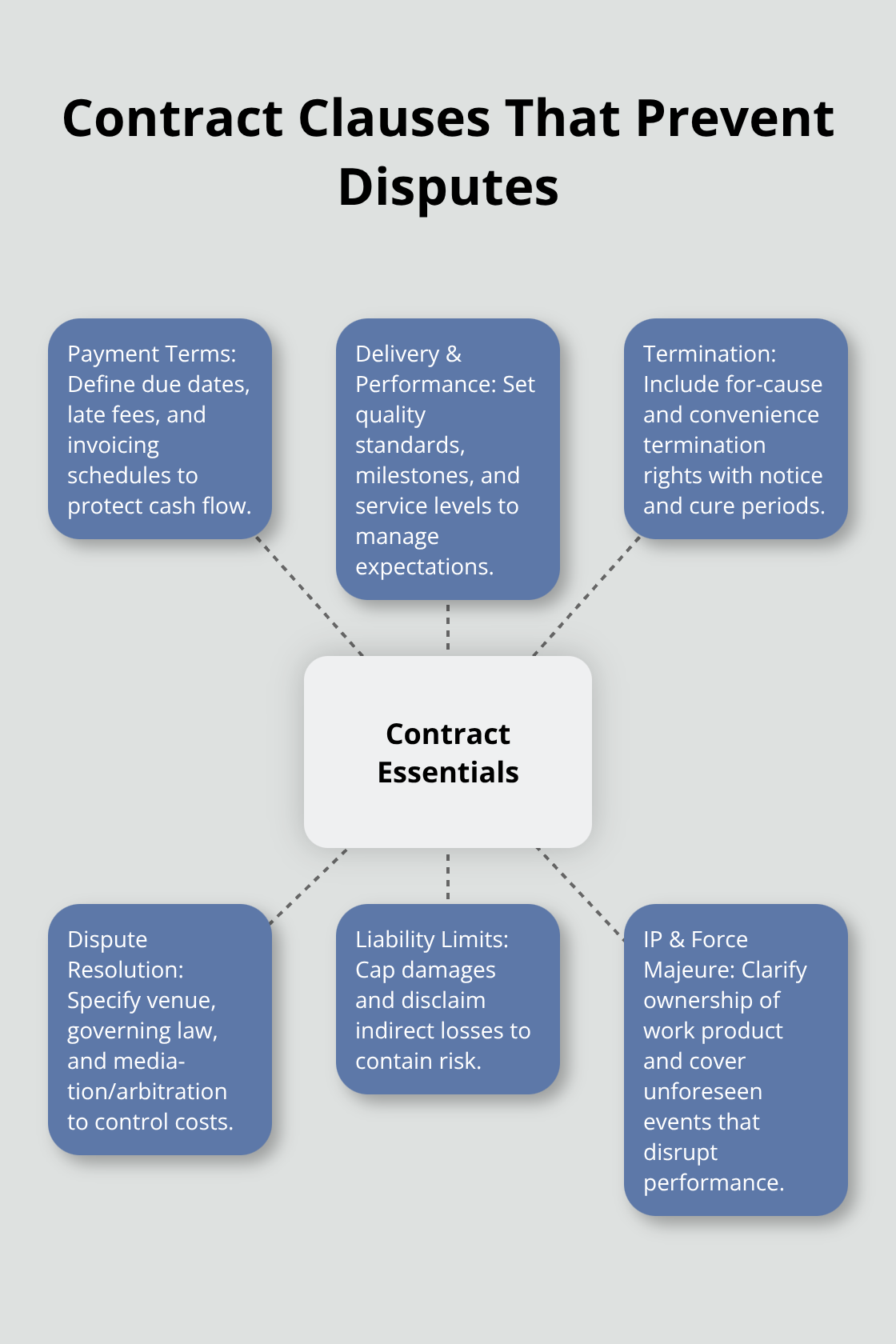

What Contract Terms Prevent Business Disasters

Poor contract management destroys more small businesses than market competition ever will. The American Bar Association found that 60% of small business litigation stems from inadequate contract terms or missing agreements entirely. Melbourne business owners who operate without written contracts face average legal costs of $43,000 per dispute, while those with proper agreements resolve conflicts for under $5,000.

Every business relationship needs written terms that define payment schedules, delivery expectations, termination procedures, and dispute resolution methods. Verbal agreements become worthless when disagreements arise, and Florida courts cannot enforce what was never documented. You must include liability limitations, intellectual property ownership clauses, and force majeure provisions that protect against circumstances beyond your control.

Trade Secrets Require Immediate Protection Strategies

Florida businesses lose $180 billion annually to trade secret theft according to the Economic Espionage Act data. Your customer lists, pricing strategies, vendor relationships, and operational procedures qualify as trade secrets when properly protected. Non-disclosure agreements must be signed before any business discussions begin, and employee contracts should include non-compete clauses that prevent workers from sharing proprietary information with competitors.

The Florida Uniform Trade Secrets Act provides legal remedies, but only when businesses take reasonable steps to maintain secrecy. You should mark confidential documents clearly, limit access to sensitive information, and require password protection for digital files. Companies that fail to protect trade secrets lose legal standing to pursue thieves in court.

Vendor Agreements Control Your Business Success

Vendor relationships determine your ability to deliver products and services consistently. Your contracts must include performance standards, quality requirements, delivery timelines, and penalty clauses for missed deadlines. The Supply Chain Management Review reports that businesses with detailed vendor agreements experience 45% fewer supply disruptions than those that operate on handshake deals.

Payment terms should favor your cash flow with net-30 or net-45 arrangements (which improve your working capital position). You need termination clauses that allow immediate contract cancellation for poor performance. Customer agreements require deposit requirements, scope limitations, and change order procedures that prevent scope creep from destroying your profit margins.

Final Thoughts

Melbourne business owners who prioritize legal compliance from day one avoid the costly mistakes that destroy unprepared companies. The Florida Department of State data shows that businesses with proper formation, employment policies, and contract management survive their first five years at rates 73% higher than those without legal foundations. Smart business owners address three priorities immediately: choose LLC formation for asset protection, implement compliant employment practices to prevent wage violations, and create written contracts for every business relationship.

These steps prevent the majority of legal disputes that cost small businesses an average of $43,000 per incident. Professional legal counsel becomes necessary when you face complex transactions, employment disputes, or contract negotiations that exceed your knowledge. We at Harnage Law PLLC provide legal advice for business owners who need to navigate Florida’s regulatory environment successfully.

Business success requires ongoing legal maintenance, not just initial formation. Regular contract reviews, policy updates, and compliance audits protect your investment and position your company for profitable growth in Melbourne’s competitive market (where proper legal foundations separate thriving businesses from failed ventures). The right legal guidance transforms potential problems into manageable business decisions.