How to Claim Spousal Social Security After Divorce?

Our Blog

How to Claim Spousal Social Security After Divorce?

Divorce changes everything about your finances, including your Social Security options. Many people don’t realize they can claim spousal Social Security benefits after divorce, even if they’ve moved on with their lives.

We at Harnage Law PLLC help clients understand these benefits and avoid costly mistakes. This guide walks you through eligibility, the application process, and strategies to maximize what you’re entitled to receive.

Who Qualifies for Spousal Social Security After Divorce

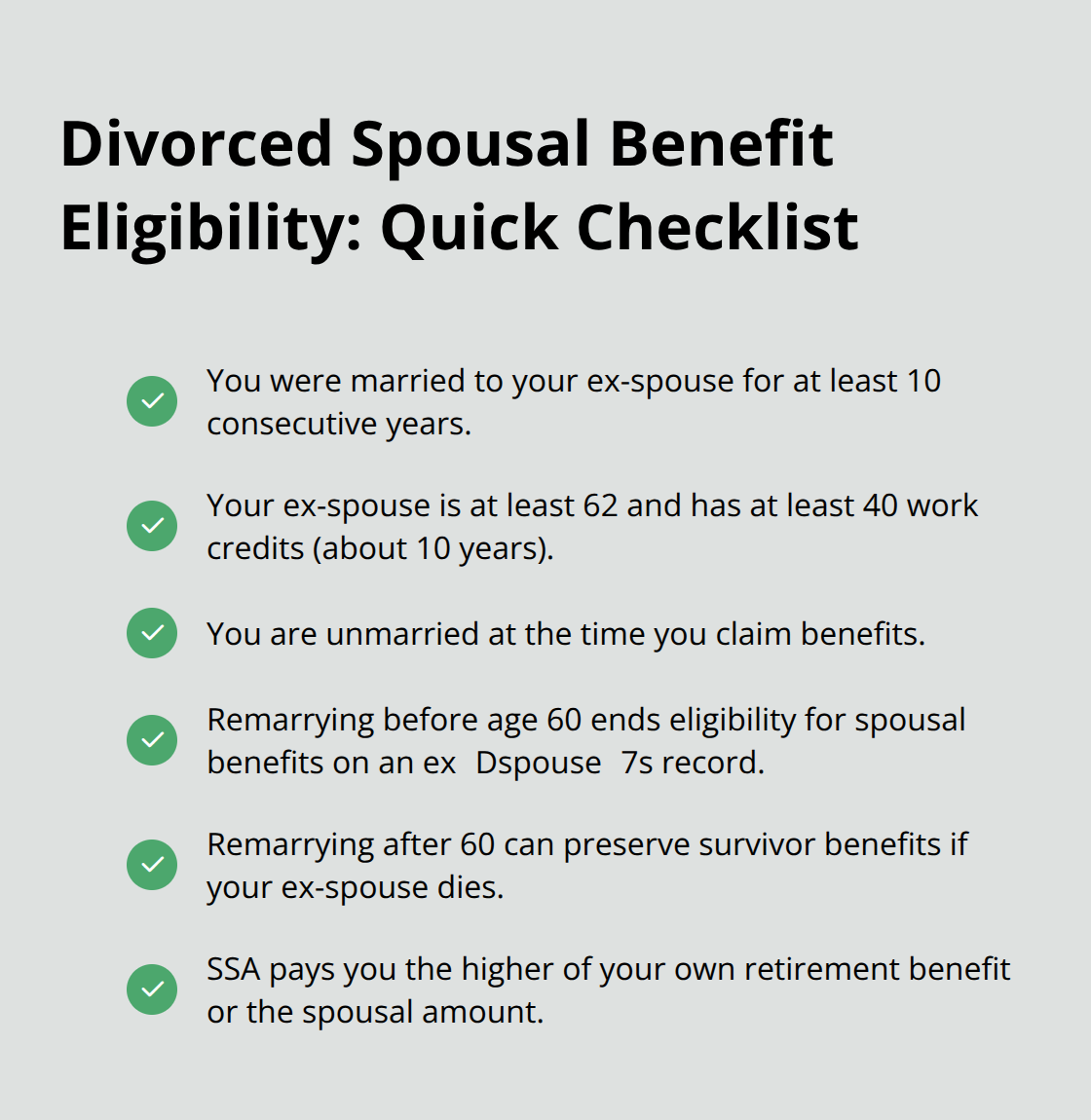

The Social Security Administration has strict eligibility rules, and most divorced people fail to meet even one of them. You must have been married for at least 10 consecutive years to claim spousal benefits based on your ex-spouse’s earnings record. This is not a soft requirement-the SSA counts every day. If you were married for 9 years and 11 months, you don’t qualify, period.

Your ex-spouse must be at least 62 years old and eligible for Social Security retirement benefits, meaning they must have accumulated at least 40 work credits (roughly 10 years of earnings). You must be unmarried at the time you claim. The moment you remarry, your eligibility for spousal benefits based on your ex-spouse’s record disappears, even if that marriage ends later. However, if you remarry after age 60, you can still claim survivor benefits if your ex-spouse passes away. This distinction matters enormously for people in their late 50s considering remarriage. According to the Social Security Administration, more than 40% of Americans nearing retirement don’t know divorced spouses can claim benefits based on an ex-spouse’s earnings at all, which means thousands of people leave money on the table annually.

Age and Timing Create Different Benefit Amounts

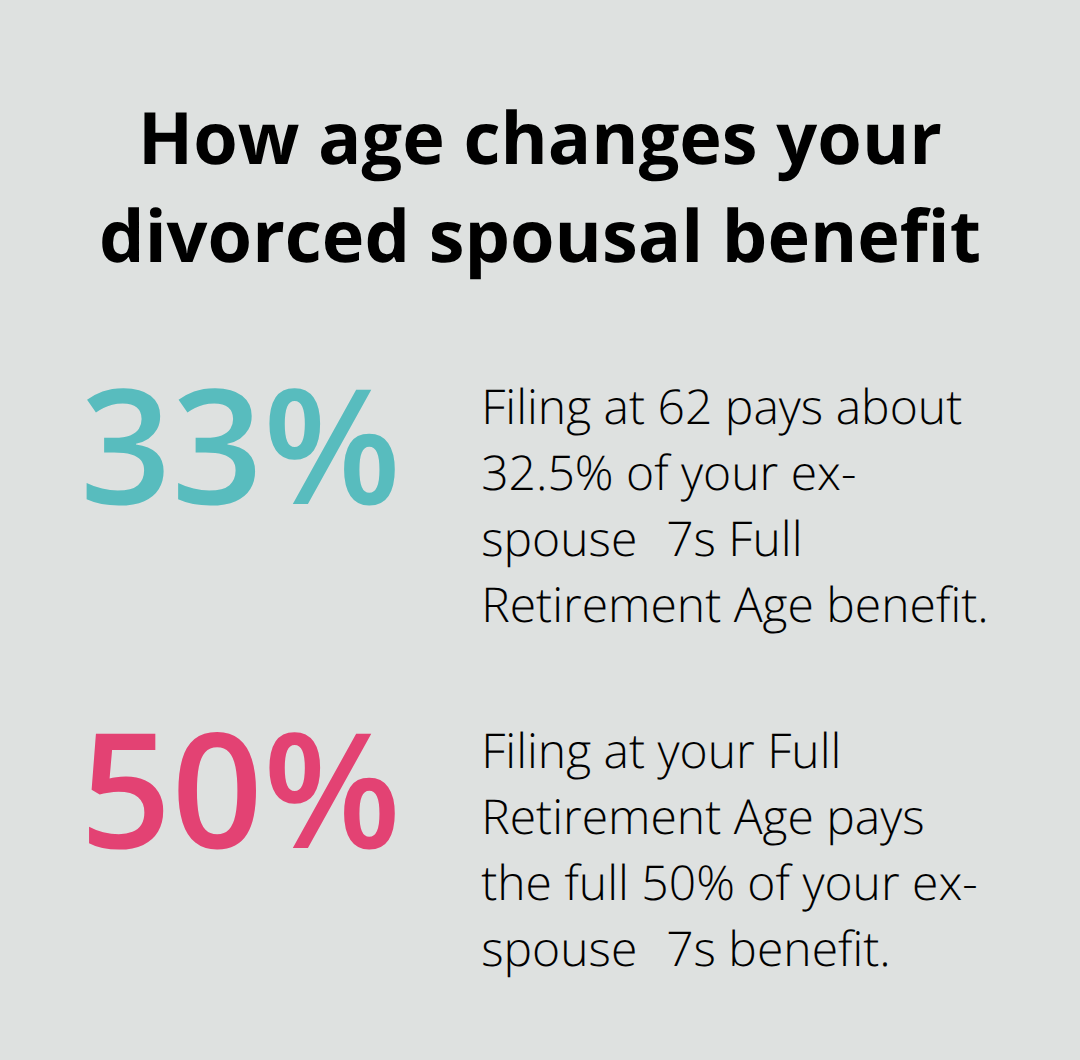

You can claim divorced spousal benefits as early as age 62, but filing early costs you significantly. If you file at 62 instead of waiting until your Full Retirement Age, the Social Security Administration reduces your benefit by approximately 25%. Filing at your Full Retirement Age-which ranges from 66 to 67 depending on your birth year-gets you the maximum spousal benefit of 50% of your ex-spouse’s Primary Insurance Amount. Delaying benefits beyond your Full Retirement Age does not increase the spousal benefit amount; the maximum remains fixed at 50%. This differs fundamentally from your own retirement benefits, which increase by 8% per year if you delay past Full Retirement Age. The SSA will automatically compute both your individual retirement benefit and your spousal benefit, then pay you whichever is higher. Many divorced people with limited work histories find the spousal benefit substantially larger than what they’d receive on their own record.

Citizenship and Residency Don’t Block Most Claims

U.S. citizenship is not required to claim divorced spousal benefits. You must be a lawful permanent resident or have valid work authorization, but naturalization is not mandatory. If you were not born in the United States, you’ll need to provide proof of U.S. citizenship or lawful alien status when you apply. Residency requirements are minimal-you don’t need to live in Florida or any particular state. The SSA processes claims from divorced people living abroad, though some countries have restrictions. The critical factor is that you meet the marriage duration, age, and unmarried status requirements. Remarriage before age 60 eliminates your eligibility entirely, making this the most consequential rule for divorced people in their 50s considering new relationships.

Understanding these eligibility rules is only the first step. The next chapter covers the specific documents you need and how to file your application with the Social Security Administration.

How to File Your Spousal Social Security Claim

Gather Your Documents First

The path from eligibility to actually receiving benefits requires precision and patience. The Social Security Administration processes claims slowly, and mistakes in your application can delay payments by months or force you to restart the entire process. Start by collecting your documents before you contact the SSA.

You’ll need your original birth certificate or a certified copy, your marriage certificate, and your final divorce decree. The SSA emphasizes that the divorce decree must clearly show the marriage lasted at least 10 years and specify how long you’ve been divorced. Some older divorce decrees contain language prohibiting spousal claims, but these restrictions are often unenforceable under current federal law-don’t assume your divorce paperwork disqualifies you without verification.

Bring W-2 forms and self-employment tax returns for the last year if you’ve worked recently, as the SSA needs to verify your earnings record. If you were born outside the United States, provide proof of citizenship or lawful alien status. The SSA accepts photocopies of most financial documents but requires originals for birth certificates and divorce decrees, which they’ll return to you. Don’t delay your application waiting for perfect documentation; the SSA will help you obtain missing records.

Submit Your Application Through Your Preferred Channel

When you’re ready to apply, you have three options. File online at SSA.gov/apply if you’re within three months of turning 62, call the Social Security Administration at 1-800-772-1213 between 8 a.m. and 7 p.m. local time Monday through Friday, or visit your local SSA office without an appointment. Online filing is fastest and avoids phone wait times that routinely exceed 30 minutes.

Have your Social Security number, date and place of birth, and your ex-spouse’s name and Social Security number ready when you apply. The SSA will ask detailed questions about your work history, military service, citizenship status, and prior marriages. Answer each question accurately; incomplete applications trigger delays and requests for clarification.

Understand How Timing Affects Your Monthly Payment

The timing of your application determines how much you receive each month for the rest of your life. Filing at age 62 gives you roughly 32.5% of your ex-spouse’s Full Retirement Age benefit, while waiting until your Full Retirement Age gives you the full 50%. The SSA will compute both your individual retirement benefit based on your own work record and your spousal benefit, then automatically pay you the higher amount.

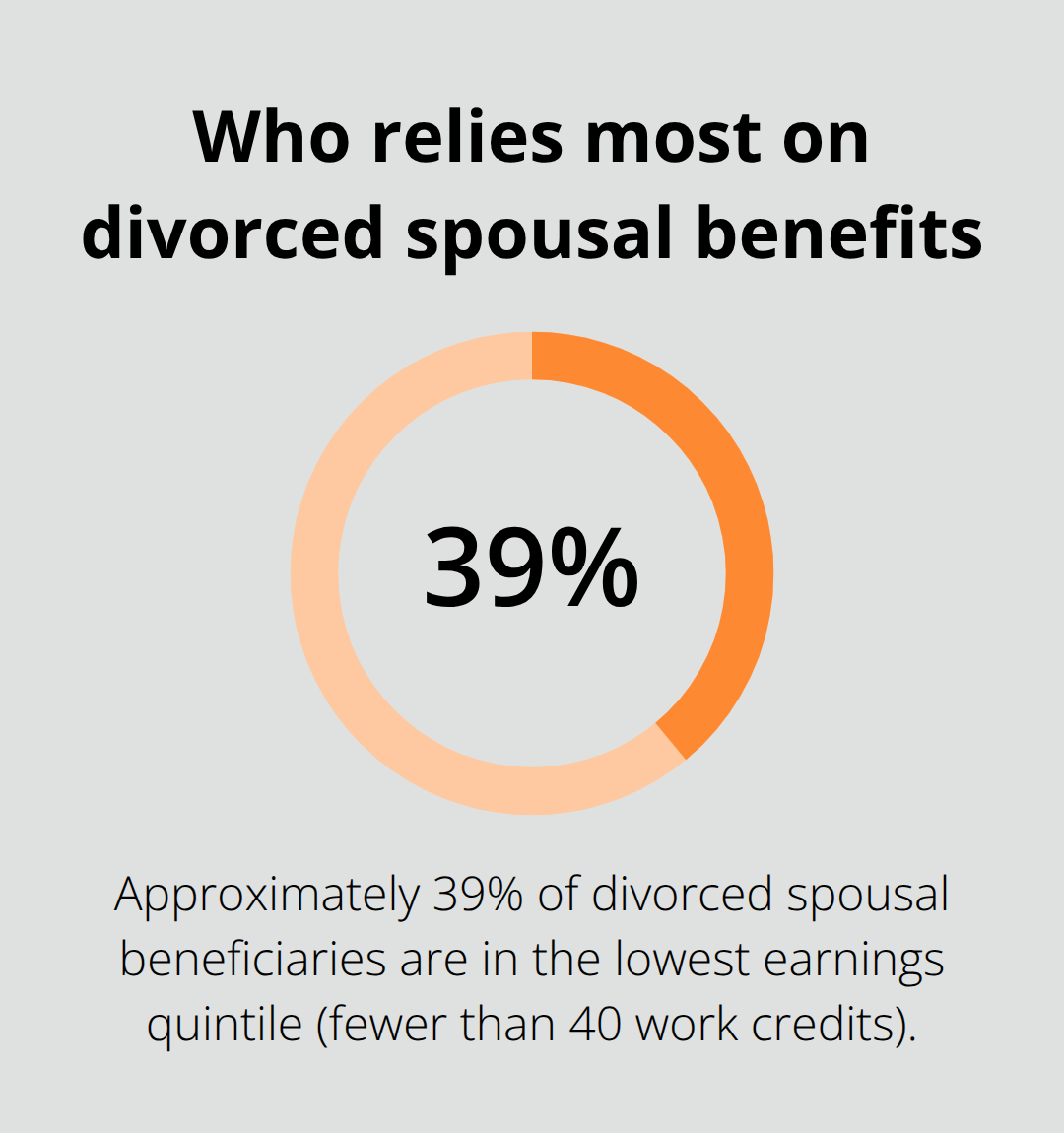

This matters enormously because many divorced people have limited work histories and find their spousal benefit substantially exceeds what they’d receive on their own earnings record. SSA data shows that in 2050, over 80% of divorced spousal beneficiaries will be women, and about 39% will fall into the lowest earnings quintile, meaning they accumulated fewer than 40 work credits on their own record.

Consider Remarriage and Earnings Impact on Your Claim

If you’re considering remarriage, file before you remarry if possible. Once you remarry before age 60, you forfeit all spousal benefits based on your ex-spouse’s record permanently. If you remarry after age 60, you preserve your right to survivor benefits if your ex-spouse dies, but you still lose the spousal benefit while remarried.

The earnings test also affects your decision about when to file. If you claim before reaching your Full Retirement Age and continue working, the SSA reduces your benefit by $1 for every $2 you earn above $23,400 annually. Once you reach your Full Retirement Age, there’s no earnings limit, and your benefit increases automatically. Many divorced people in their early 60s continue working, making it financially smarter to delay claiming until they stop working or reach Full Retirement Age.

The next chapter covers strategies to maximize your spousal benefits and coordinate your claim with your own retirement benefits.

How to Maximize Your Spousal Social Security Benefit

The difference between filing at 62 and waiting until your Full Retirement Age can mean hundreds of thousands of dollars over your lifetime. Many divorced people make the timing decision based on emotion or immediate financial pressure rather than cold mathematics. If your ex-spouse earned significantly more than you did, the spousal benefit likely exceeds what you’d receive on your own work record, making the timing decision even more consequential. The Social Security Administration automatically calculates both amounts and pays you the higher one, but understanding which benefit dominates your situation changes everything about when you should file. According to SSA data, approximately 39% of divorced spousal beneficiaries fall into the lowest earnings quintile, meaning they accumulated fewer than 40 work credits on their own record. For these individuals, the spousal benefit isn’t supplementary-it’s the primary source of retirement income.

If you earned consistently throughout your career, your own retirement benefit might exceed the spousal amount, shifting the optimal filing strategy entirely.

Calculate Your Benefits Before You Decide

Calculate your Full Retirement Age benefit first using the Social Security Administration’s online calculator. Enter your birth date, current earnings, and estimated future earnings to see what you’d receive at age 62, your Full Retirement Age, and age 70. Then contact the SSA at 1-800-772-1213 to request an estimate of your spousal benefit based on your ex-spouse’s earnings record. Comparing these two numbers side-by-side reveals which benefit will dominate throughout your retirement.

The Working Years Problem Most Divorced People Ignore

Claiming before your Full Retirement Age while still working creates a hidden penalty that devastates your lifetime benefits. The earnings test reduces your Social Security benefit by one dollar for every two dollars you earn above $23,400 annually. If you claim at 62 and earn $50,000 that year, the SSA withholds approximately $13,300 in benefits. Many divorced people in their early 60s continue working full-time, making an early claim financially disastrous. The earnings limit disappears entirely once you reach your Full Retirement Age, and your benefit increases permanently to account for months you didn’t receive payments. Delaying your claim from 62 to 67 while working full-time often produces a larger lifetime benefit than claiming immediately, even accounting for the years you receive nothing. This reverses the conventional wisdom that you should claim as soon as possible.

Work with the Social Security Administration’s Earnings Test Calculator to model your specific situation. Input your expected annual earnings for the next several years alongside your projected benefits at different claiming ages. The results frequently surprise people who assumed early claiming made sense. If you plan to stop working at 65 but won’t reach your Full Retirement Age until 67, waiting those two additional years without the earnings penalty dramatically increases your monthly benefit.

Remarriage Changes Everything About Your Strategy

The remarriage rule creates a hard deadline that overrides all other considerations. If you’re in a relationship and considering marriage before age 60, file for your spousal benefits first. Once you remarry, you lose access to spousal benefits based on your ex-spouse’s record permanently, even if that subsequent marriage ends in divorce. The SSA doesn’t restore spousal benefits from a prior ex-spouse after you remarry and then divorce again. This rule catches people off guard because it feels arbitrary, but the SSA enforces it strictly.

If you’re 58 or 59 and in a serious relationship, filing at 62 after the relationship ends becomes your only option. If you remarry at 59, you’ve permanently forfeited any spousal benefit. Conversely, if you remarry after age 60, you preserve survivor benefits if your ex-spouse dies, though you still lose the spousal benefit while remarried. This distinction matters profoundly for people in their late 50s making major life decisions. The mathematics sometimes justify delaying marriage or formalizing a commitment through means other than remarriage until you reach age 60 and file for spousal benefits. This isn’t romantic advice-it’s financial reality. Coordinate your divorce decree, alimony structure, and Social Security filing strategy together rather than treating them as separate decisions.

Final Thoughts

Claiming spousal Social Security benefits after divorce requires precision and timing that most people underestimate. The 10-year marriage requirement, the remarriage restriction before age 60, and the earnings test all interact in ways that dramatically affect your lifetime benefits. Many divorced people leave hundreds of thousands of dollars unclaimed simply because they didn’t know these benefits existed or misunderstood the filing rules.

Filing too early without calculating the long-term cost represents the most common mistake. Claiming at 62 instead of waiting until your Full Retirement Age reduces your monthly benefit by roughly 25 percent permanently. If you’re still working, the earnings test compounds this damage by withholding additional benefits, making it financially smarter to delay your claim until you stop working or reach your Full Retirement Age.

Contact the Social Security Administration at 1-800-772-1213 to verify your eligibility and request a benefit estimate based on your ex-spouse’s earnings record. Gather your birth certificate, marriage certificate, and final divorce decree before you call, then compare your projected spousal benefit against what you’d receive on your own work record using the SSA’s online calculator. If your divorce involved complex financial arrangements or disputes about spousal Social Security benefits after divorce, contact us at Harnage Law PLLC to discuss your situation and ensure your divorce agreement protects your retirement income.