Legal Essentials for Business Startups: What to Consider

Our Blog

Legal Essentials for Business Startups: What to Consider

Starting a business in Melbourne, Florida requires navigating complex legal requirements that can make or break your venture. The wrong business structure or missed compliance step costs entrepreneurs thousands in penalties and legal fees.

We at Harnage Law PLLC see startups struggle with these foundational decisions daily. Getting proper legal advice for business startups from the beginning protects your investment and sets you up for sustainable growth.

Which Business Structure Protects Your Melbourne Startup Best

Sole proprietorships offer the simplest path but leave you personally liable for every business debt and lawsuit. Your home, savings, and personal assets become targets when business problems arise. LLCs create a protective barrier between your personal wealth and business liabilities while they maintain tax flexibility. The Florida Department of State requires LLC registration with a $125 filing fee and registered agent designation. Corporations deliver the strongest liability protection but face double taxation on profits (once at the corporate level and again on distributions to owners).

Tax Strategy Makes the Difference

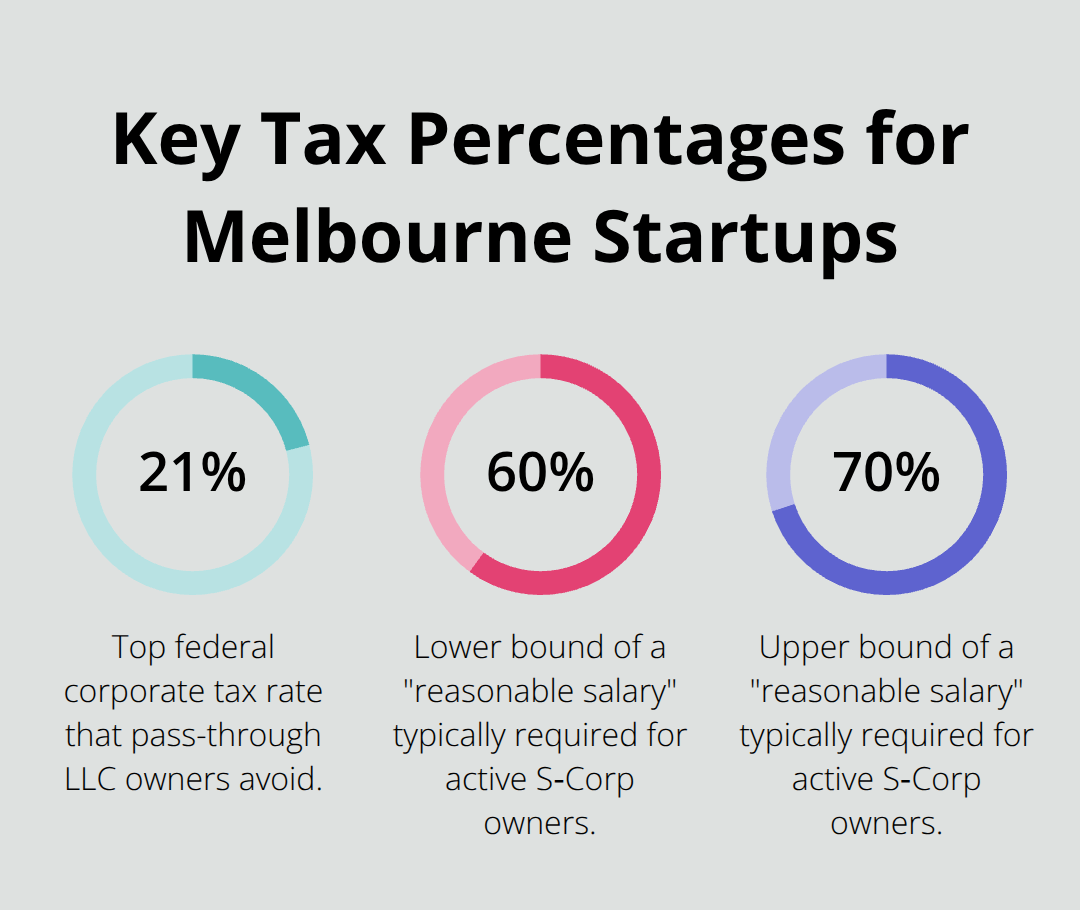

Florida’s lack of state income tax benefits all structures, but federal obligations vary dramatically. LLC owners report business income on personal returns and avoid corporate tax rates that can reach 21 percent. S-Corporation elections allow LLC owners to split income between salary and distributions, which potentially saves thousands in self-employment taxes. The IRS requires reasonable salary payments to active owners, typically 60-70 percent of total compensation based on industry standards.

C-Corporations face the highest tax burden but offer unlimited growth potential and easier access to venture capital funds.

Registration Requirements That Matter

Florida mandates registered agents for LLCs and corporations – someone available during business hours to receive legal documents. The Department of State processes online filings within 3-5 business days for standard applications. Annual reports cost $138.75 for LLCs and must be filed by May 1st each year to maintain good standing.

Corporations pay $150 annually with reports due by March 1st. Foreign entities that operate in Florida need separate registration even if formed in other states (adding $125 to startup costs).

Asset Protection Beyond Business Structure

Your choice of business entity represents just the first layer of asset protection. Smart entrepreneurs combine proper structure selection with comprehensive insurance coverage and strategic asset placement to maximize protection from potential creditors and lawsuits.

How Do You Protect Business Assets From Day One

Trademark registration through the United States Patent and Trademark Office costs $250-$350 per class and provides nationwide protection for 10 years with renewal options. Melbourne businesses should file applications within six months of first use to secure priority dates and prevent competitors from claiming similar marks. The USPTO processes applications in 8-12 months, but common law rights begin immediately with business use. Copyright protection applies automatically to original works like marketing materials, software code, and training manuals without registration fees, though formal filing costs $45-$65 and strengthens legal standing in infringement cases.

Employment Contracts That Actually Work

Non-disclosure agreements must include specific confidentiality periods (typically 2-5 years depending on information sensitivity) and clear definitions of protected materials to withstand legal challenges. Florida courts enforce reasonable non-compete clauses that span 6 months to 2 years for key employees, but geographic restrictions cannot exceed actual business territories. Employment contracts should specify intellectual property ownership, with work-for-hire clauses that cover all employee-created materials during business hours or when employees use company resources. Standard agreements cost $500-$1,500 to draft properly but prevent disputes worth thousands in litigation fees later.

Insurance Requirements That Matter

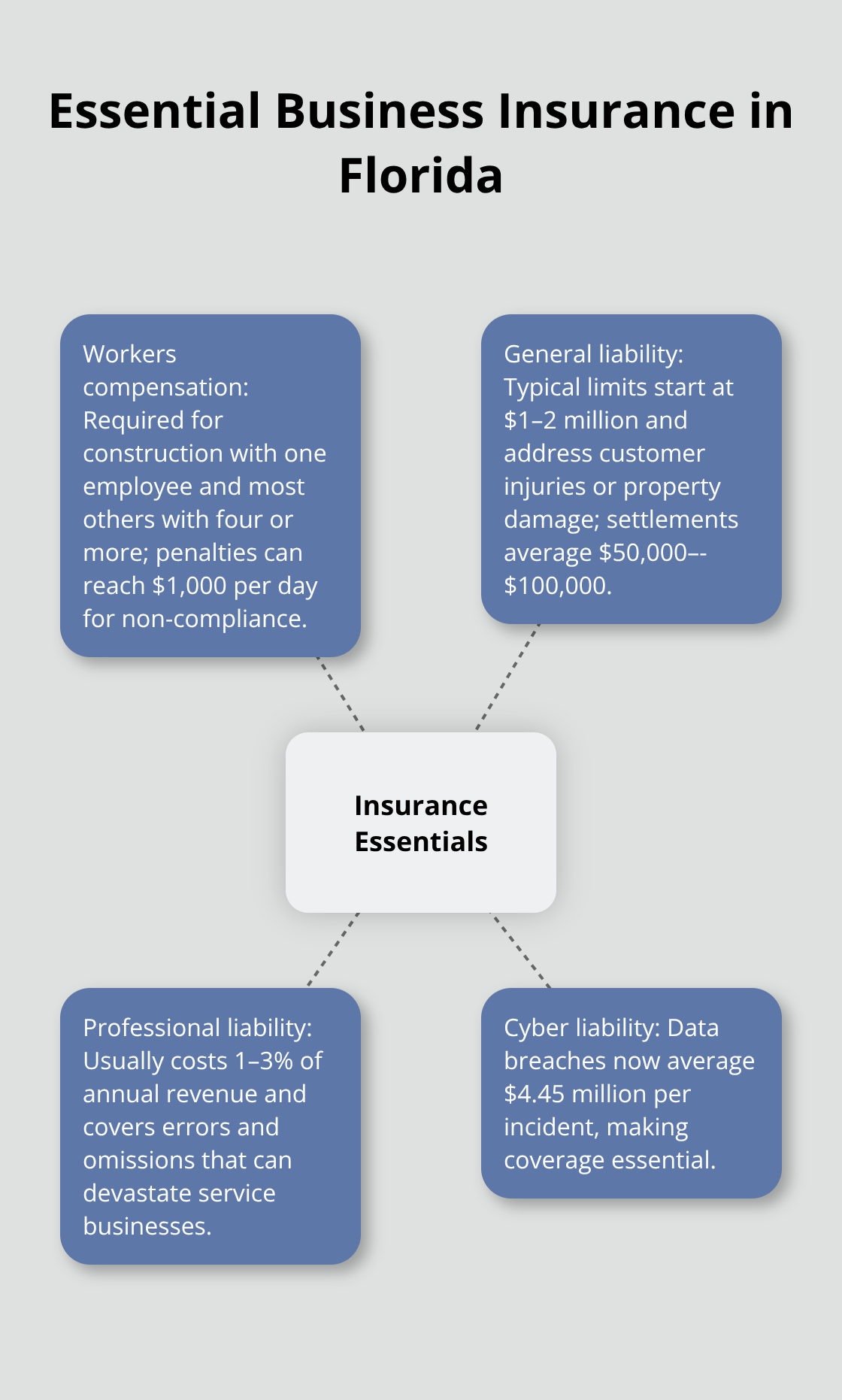

Florida requires workers compensation insurance for construction companies with one employee and all other businesses with four or more employees, with penalties that reach $1,000 per day for non-compliance according to the Florida Department of Financial Services. General liability coverage that starts at $1-2 million protects against customer injuries and property damage claims that average $50,000-$100,000 in settlements. Professional liability insurance costs 1-3 percent of annual revenue but covers errors and omissions claims that can destroy service-based businesses.

Cyber liability policies have become essential as data breach costs average $4.45 million per incident (according to IBM Security research).

Risk Management Beyond Insurance

Smart asset protection extends beyond basic insurance coverage and requires strategic business practices that minimize exposure to potential lawsuits and creditor claims. Business owners need comprehensive protection strategies that address regulatory compliance and operational risks. The next step involves understanding Florida’s complex compliance landscape and regulatory requirements that govern daily business operations.

What Compliance Steps Cannot Wait in Melbourne

Florida businesses face immediate license requirements that vary dramatically by industry and location. The Florida Department of Business and Professional Regulation oversees more than 50 licensed professions, from construction contractors who need $75,000 bonds to restaurants that must obtain health department permits within 30 days of opening. Melbourne businesses must secure both city and Brevard County business tax receipts, with costs that range from $25 for home-based services to $500+ for manufacturing operations. The City of Melbourne Planning and Zoning Division requires specific zoning compliance before operations begin, and violations result in immediate shutdown orders that cost businesses $10,000-$50,000 in lost revenue during resolution periods.

Employment Classification Mistakes Cost More Than You Think

The Department of Labor recovered $322 million in back wages for misclassified workers in 2023, with Florida accounting for significant enforcement actions. Independent contractors must pass the ABC test: work performed without company control, falls outside normal business scope, and involves established independent trades or businesses. Misclassification penalties include 100 percent of unpaid employment taxes, plus interest and fines that often double the original amount. Workers compensation fraud charges apply when contractors should be employees, which carry criminal penalties up to five years imprisonment. Florida minimum wage reaches $12 per hour in 2024, and overtime violations average $15,000 per affected employee in settlements.

Contract Terms That Actually Protect Your Business

Vendor agreements need termination clauses that allow 30-day notice periods and specific performance standards with measurable penalties for delays or quality issues. Payment terms should specify net-30 maximum with 2 percent early payment discounts and automatic late fees that start at 1.5 percent monthly. Force majeure clauses must include specific events like hurricanes (common in Florida) and supply chain disruptions, with clear procedures for contract suspension and resumption. Indemnification provisions should require vendors to carry $1 million minimum liability coverage and name your business as additional insured on their policies.

License Requirements That Vary by Industry

Professional service businesses face different requirements than retail operations or manufacturing companies. Restaurants must obtain permits from Brevard County Environmental Health Services and pass inspections before they serve customers. Construction companies need state contractor licenses and must file Construction Service Affidavits with local authorities. Daycare centers require permits from the Florida Department of Children & Families to meet health and safety regulations. Alcohol-serving establishments need approval from the Division of Alcohol and Tobacco within the Florida Department of Business and Professional Regulation. Property management companies and landlords must understand their legal obligations regarding tenant rights and property maintenance requirements.

Final Thoughts

Melbourne startups that skip legal foundations face predictable disasters. The Small Business Administration reports 20 percent of new businesses fail within their first year, often due to preventable legal mistakes that proper planning could have avoided. Smart entrepreneurs tackle business structure selection, trademark registration, and compliance requirements before they open their doors.

These steps cost thousands upfront but prevent tens of thousands in penalties and litigation fees later. Florida’s complex regulatory environment demands attention to license requirements, employment law compliance, and contract protections that vary significantly by industry and location. Legal advice for business startups becomes most valuable during formation when mistakes cost less to fix (waiting until problems arise multiplies expenses and limits available solutions).

We at Harnage Law PLLC help Melbourne entrepreneurs build solid legal foundations that support long-term success. Our approach addresses business formation, compliance requirements, and asset protection strategies that give startups competitive advantages from day one. Strong legal groundwork transforms business dreams into profitable realities.