Melbourne Florida Child Support Guidelines

Our Blog

Melbourne Florida Child Support Guidelines

Child support guidelines in Melbourne, Florida play a vital role in ensuring children’s financial needs are met after their parents separate or divorce. At Harnage Law PLLC, we understand the complexities of these guidelines and their impact on families.

This blog post will break down the key aspects of child support calculations, modifications, and enforcement in Melbourne. We’ll provide clear insights to help parents navigate this often challenging aspect of family law.

What Is Child Support in Melbourne, Florida?

Definition and Purpose

Child support in Melbourne, Florida represents a financial obligation parents owe to their children after separation or divorce. This support covers basic needs such as food, shelter, clothing, and education. The primary goal is to maintain the child’s standard of living as if the parents were still together.

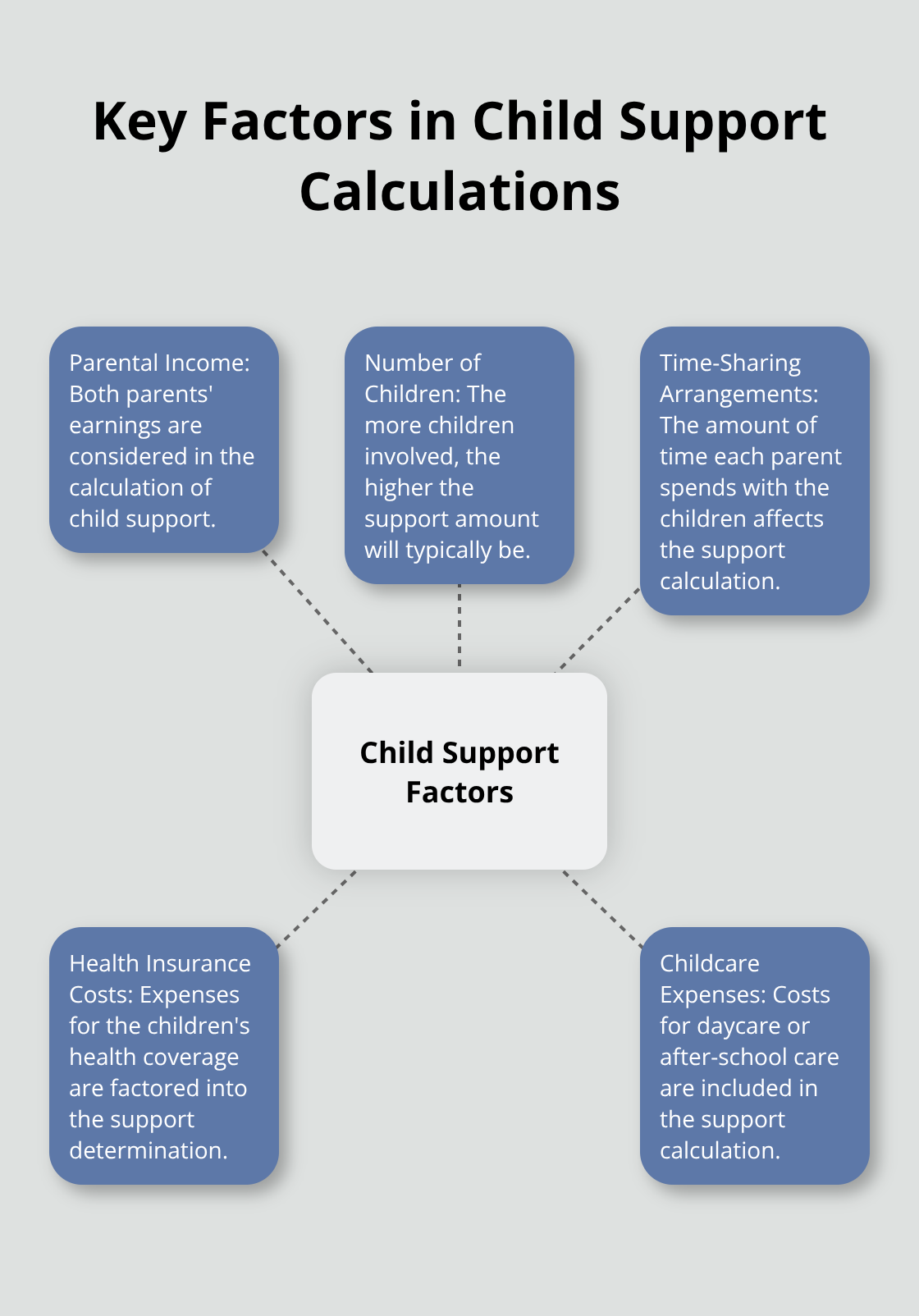

Key Factors in Child Support Calculations

Several elements influence child support determinations in Melbourne:

- Parental Income: Both parents’ earnings are considered.

- Number of Children: The more children, the higher the support amount.

- Time-Sharing Arrangements: The amount of time each parent spends with the children affects the calculation.

- Health Insurance Costs: Expenses for the children’s health coverage are factored in.

- Childcare Expenses: Costs for daycare or after-school care are included.

For instance, a parent earning $50,000 annually will likely pay more than one earning $30,000. However, if the higher-earning parent has the children 40% of the time, their payment might decrease compared to a parent with only weekend visitation.

Beyond Basic Support

Child support in Melbourne extends beyond a monthly check. It can encompass:

- Extracurricular Activities: Sports, music lessons, or other hobbies.

- School Supplies: Textbooks, uniforms, and other educational materials.

- College Costs: In some cases, support may extend to higher education expenses.

Judges may order parents to contribute to these additional expenses based on their respective incomes.

Modifications to Child Support Orders

Child support orders in Melbourne aren’t set in stone. They can be modified if a substantial change in circumstances occurs. Examples include:

- Job Loss: A parent’s unemployment may lead to a temporary reduction.

- Significant Pay Raise: An increase in income could result in higher payments.

- Change in Time-Sharing: Alterations to the parenting schedule may affect support amounts.

These modifications ensure that support remains fair and reflective of current situations.

As we move forward, it’s important to understand how these child support guidelines are calculated in Melbourne, Florida. The next section will explore the specific methods and formulas used to determine child support amounts, providing a clearer picture of what parents can expect in their own cases.

How Melbourne, Florida Calculates Child Support

The Income Shares Model

Melbourne, Florida uses the Income Shares Model to calculate child support. This model considers both parents’ incomes and the time each spends with the child. The Florida Department of Revenue applies this model to ensure fairness and consistency in child support determinations.

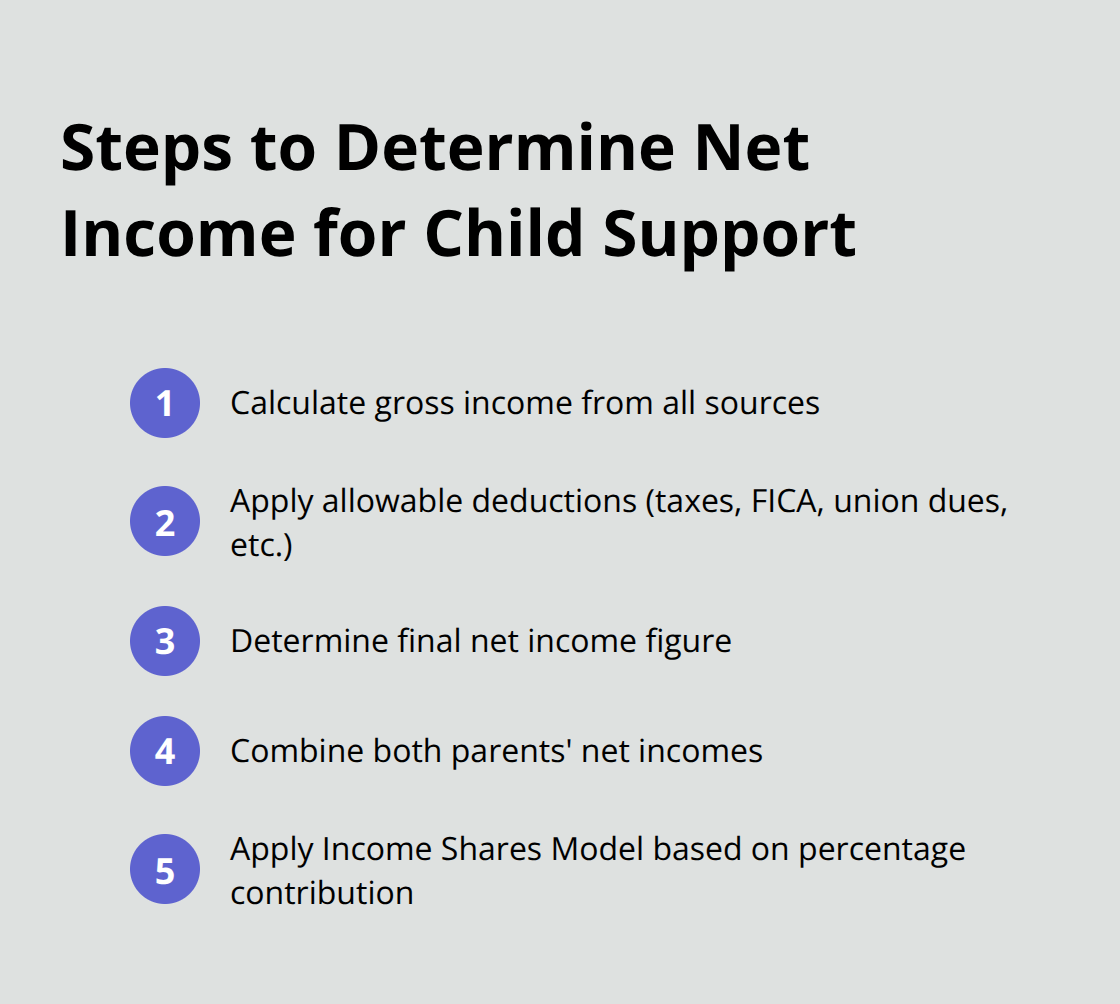

Net Income Determination

The first step in the calculation process involves determining each parent’s net income. This includes:

- Salary and wages

- Bonuses and commissions

- Business income

- Disability benefits

- Workers’ compensation

- Unemployment benefits

- Pension or retirement income

- Rental income

- Interest and dividends

From the gross income, certain deductions apply:

- Federal, state, and local income tax

- FICA (Social Security and Medicare) taxes

- Mandatory union dues

- Health insurance premiums (excluding coverage for the child)

- Court-ordered support for other children

For instance, a parent with an annual income of $60,000 might have a net income of $45,000 after these deductions.

Application of the Income Shares Model

After establishing net incomes, they combine to determine the total amount available for child support. This total splits based on each parent’s percentage of the combined income.

Consider this example: Parent A earns $45,000 and Parent B earns $30,000, resulting in a combined income of $75,000. Parent A becomes responsible for 60% of the support, while Parent B covers 40%.

The state guidelines then provide a base support amount based on the combined income and number of children. If the guideline amount for one child is $1,000 per month, Parent A would owe $600, and Parent B would owe $400.

Time-Sharing Adjustments

The amount of time each parent spends with the child can significantly impact the final support amount. If one parent has the child for more than 20% of overnights (73 nights per year), their support obligation may decrease.

Healthcare and Childcare Considerations

Child support calculations also factor in healthcare and childcare costs. These expenses typically split proportionally based on each parent’s income.

For example, if monthly childcare costs are $500, Parent A might pay $300 (60%) and Parent B $200 (40%). The same principle applies to health insurance premiums and out-of-pocket medical expenses for the child.

While online calculators can provide estimates, they don’t account for all factors a judge might consider. For accurate calculations tailored to your specific situation, consulting with a family law attorney proves beneficial. The next section will explore the circumstances that may warrant modifications to existing child support orders and the process for requesting such changes.

Can Child Support Orders Change in Melbourne, Florida?

Circumstances for Modifications

Child support orders in Melbourne, Florida can change. Life doesn’t remain static, and support obligations can adapt. Parents might request modifications for several reasons:

- Income Changes: A 15% or greater shift in income (up or down) may qualify for support adjustments.

- Job Loss: Unemployment can lead to temporary reductions in payments.

- Parenting Time Shifts: Alterations in time-sharing arrangements may affect support amounts.

- Child’s Needs: New medical conditions or increased expenses as children age might justify higher support.

The Modification Process

To modify a child support order in Melbourne, follow these steps:

- Document Changes: Collect evidence (pay stubs, tax returns, medical records) to support your case.

- File a Petition: Submit a formal request to the Brevard County court.

- Serve the Other Parent: Allow 20 days for a response.

- Attend a Hearing: Present your case to the judge if the other parent contests.

- Obtain New Order: If approved, the judge will issue a modified support order.

Enforcement Methods

When parents fail to pay child support, Melbourne courts employ various enforcement tactics:

- Income Withholding: Support deducts automatically from paychecks.

- License Suspension: Driver’s, professional, or recreational licenses may be suspended.

- Asset Seizure: Courts can seize bank accounts or other assets.

- Contempt of Court: Willful non-payment may result in fines or jail time.

- Federal Prosecution: Parents owing over $5,000 or non-paying for over a year face potential federal charges.

Effectiveness of Enforcement

The Florida Department of Revenue reported collecting over $1.1 billion in child support payments in 2022 (demonstrating the effectiveness of these measures). This statistic underscores the seriousness with which the state views child support obligations.

Proactive Communication

Parents should maintain open lines of communication with each other and the court. This approach often prevents the need for harsh enforcement actions. If payment struggles arise, seeking a modification proactively is preferable to falling behind.

Final Thoughts

Child support guidelines in Melbourne, Florida ensure children receive financial support after parental separation. These guidelines consider parental income, time-sharing arrangements, and additional expenses to calculate fair support amounts. Parents must understand and follow child support orders for the well-being of their children and to maintain effective co-parenting relationships.

Life changes can affect child support obligations. Job loss, income fluctuations, or shifts in parenting time may require modifications to existing orders. Parents should communicate openly and seek legal advice when circumstances change to maintain appropriate support levels.

The Florida Department of Revenue assists with enforcement and collection of child support. Local family courts provide information on filing for modifications. Experienced family law attorneys at Harnage Law PLLC can guide parents through the complexities of child support guidelines in Melbourne, Florida (helping them navigate the system effectively).